- ETF Focus

- Posts

- 5 ETFs I'm Thankful For This Holiday Season

5 ETFs I'm Thankful For This Holiday Season

Because of their overall quality, smart portfolio construction or low cost access to the market they target, each of these funds makes a lot of sense for any investor.

Happy Thanksgiving to all! I hope you all had a chance to enjoy some downtime (I was more than happy to be able to disconnect for the entire day to enjoy some food and football) and found the time to slow down to appreciate everything you have and everything to be thankful for!

The financial markets mostly gave us things to be thankful for this year, especially if you were invested in large-caps, growth and/or tech stocks. Other areas of the equity markets delivered only middling returns with most defensive sectors, including healthcare, consumer staples and utilities, still in the red. Treasury bills finally gave income seekers the risk-free high yield that they’ve been waiting years for, but long-term Treasuries are still more than 40% below their 2020 peak.

The U.S. economy has also given us a few reasons to be grateful. The recession that many market watchers were expecting at the beginning of the year has yet to come to fruition. GDP growth is still firmly in positive territory and the labor market has remained far more resilient for far longer than almost anyone expected. If jobs remain plentiful, inflation can stay under control and consumers can somehow continue to find the means to spend, it’s possible that the long-awaited recession could be delayed even longer. Given the preponderance of data, I don’t think recession will be avoided altogether, but how the economy has managed to hold up for this long has been impressive.

The ETF marketplace has had another big year in terms of both net flows and additional investment opportunities for investors. More than 400 new ETFs have been launched in 2023 and investors were able to invest in almost any sector, region and theme even before they hit the market! Investors have access to ultra-low cost funds across virtually every asset class like never before!

There are a few, however, that I’m particularly thankful for this season. They’ve done a great job of offering investors smart, well-constructed, low cost strategies that are perfect for almost every portfolio and do an excellent job of creating long-term wealth.

WisdomTree U.S. Quality Dividend Growth ETF (DGRW)

While dividend strategies haven’t been in favor at all in 2023, that doesn’t mean they don’t belong in your portfolio. I talk all the time about how I much prefer using multi-factor approaches when investing in dividend ETFs because single-factor approaches, such as just high yield or dividend growth, can leave open the possibility of including some bad apples in the portfolio. Using a pair of strategies within a single fund acts as a cross-check against the other strategy and produces an overall better quality fund.

DGRW, in my opinion, is one of the best in the business. The index it’s based on is comprised of 300 dividend-paying companies with the best combined rank of growth (long-term earnings growth expectations) and quality (ROE and ROA) factors. Like other WisdomTree ETFs, weighted by aggregate cash dividends paid as opposed to yield or market cap.

The “dividend growth” in the fund’s name might be a slight misnomer since the selection criteria doesn’t specifically require a dividend growth history, but over its lifetime, the fund has grown its dividend by about 10% annually. The sub-2% yield won’t get income seekers too excited and the 0.28% expense ratio is a little on the high side, but the portfolio construction and composition are ideal for almost any investor.

SPDR Bloomberg 1-3 Month Treasury Bill ETF (BIL)

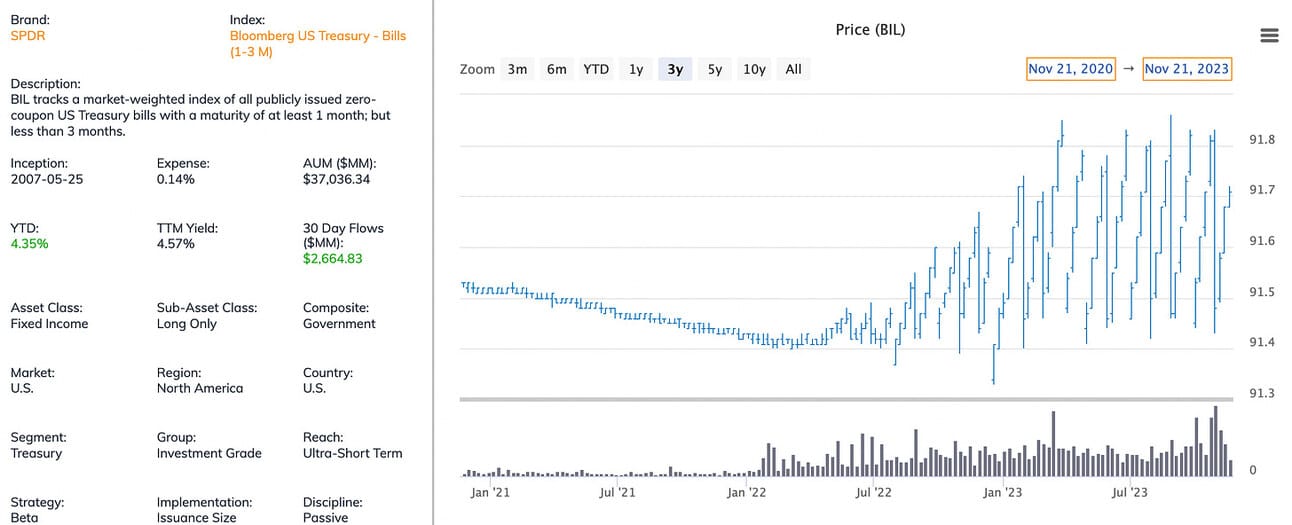

This fund is a great example of the ETF industry providing the necessary, narrow exposure to an area of the market that finally begins working after so many lean years. Even when Treasury bill yields were essentially 0%, BIL still had about $2-3 billion in total assets. Since the Fed began its aggressive rate hiking cycle and short-term yields began taking off, BIL has swollen to more than $37 billion in assets, but, more importantly, is providing investors with easy access to the Treasury market.

If you were to go and buy Treasury bills on your own, you might need to come up with thousands of dollars up front just to buy a single bill. For a lot of investors, trading in the bond market can be intimidating and and it could be easy to make an unintended mistake. BIL makes it simple for anyone to buy as little as one share through their existing brokerage account and often do it without paying a commission. The 0.14% expense ratio also means you’re paying next to nothing to grab these risk-free 5% yields.

Invesco S&P 500 Equal Weight ETF (RSP)

Throughout 2023, all we’ve heard about is the “magnificent 7” stocks - all of which of mega-cap growth/tech. Because they dominate so many market cap weighted indices, it’s easy to look at the major market averages and assume that the whole market is rising. If you look more broadly, you’ll see that small-caps are lagging badly, international stocks are struggling and defensive sectors & dividend stocks are having a tough time just breaking even. The big 7 stocks have driven almost all market gains this year and that’s not a good thing.

RSP has similarly underperformed this year since underweighting the equity market’s biggest winners hasn’t paid off. It won’t always be that way though. Over the long-term, market gains are much more spread out more often than not. Small-caps and international stocks can have extended periods of outperformance and we’re certainly overdue for those right now. In terms of providing more diversified market exposure, RSP is the better choice. Because it still sticks with the S&P 500, you’re still getting all large-cap exposure, which might be preferable for those not yet comfortable with adding small-caps. If you’re convinced large-caps will still lead, this is a better way to approach the index.

Invesco S&P 500 Quality ETF (SPHQ)

Similar to the other funds mentioned above, quality hasn’t had nearly the success of anything not heavily invested in growth & tech. In 2022, however, quality demonstrated how well it can do when conditions are right. Last year was a time when neither stocks or bonds were working and investors fled to anything that might have provided some margin of safety. Quality stocks, which focus on healthy balance sheets and strong cash flows, were just the right solutions. Even though gains were minimal, they provided an excellent counterbalance to growth strategies and mitigated quite a bit of downside risk.

Even in non-favorable markets, quality stocks deserve an allocation in almost every portfolio. Using durable and successful stocks as the cornerstone of a portfolio built for long-term success is pretty self-explanatory. The fact that this ETF can be owned for a tiny 0.15% expense ratio is just another added benefit.

VanEck Morningstar Wide Moat ETF (MOAT)

Investing in companies with wide moats, or competitive advantages that are difficult for other competitors to break through, is one of the more successful thematic strategies available to investors. What qualifies as a “moat” is pretty objective. There’s no one magic formula and it requires seasoned analysts and money managers to identify them. In MOAT’s case, it’s relying on the expertise of Morningstar, one of the best-known and most successful research firms around, to pick out these companies.

Over the past 10 years, MOAT has returned more than 12% annually, which puts it in the top 3% of Morningstar’s large blend category. Like quality ETFs, the fund’s portfolio consists of roughly 50 different companies that should be able to withstand tougher economic environments and benefit from their competitive advantages.

Reply