- ETF Focus

- Posts

- Best Performing U.S. Dividend ETFs for the 1st Half of 2024

Best Performing U.S. Dividend ETFs for the 1st Half of 2024

The more exposure you had to the magnificent 7, the better you performed.

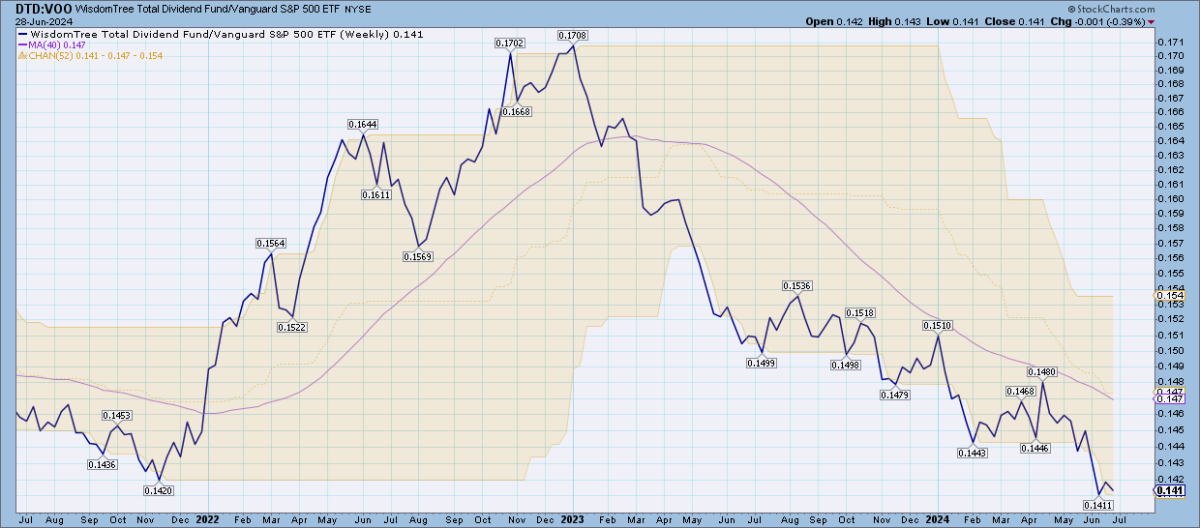

In 2023, dividend stocks steadily underperformed the S&P 500 and Nasdaq 100 as tech stocks roared and the AI revolution began. With some choppiness along the way, the story has been largely the same in 2024. They lagged in January when the market thought the Fed was going to cut rates 6-7 times over the course of the year, but began to lead the S&P 500 again as investors dialed back their most dovish expectations. Since April, dividend payers have been badly lagging the S&P 500 yet again.

Year-to-date, the WisdomTree U.S. Total Dividend ETF (DTD) is up a little over 9% compared to a 15% gain for the S&P 500. That return isn't that bad considering that seven S&P sectors, including consumer staples, industrials and healthcare, which usually supply a lot of dividend ETFs, performed even worse than that, but it underscores how top heavy this market has been. Again, tech and communication services are the best-performing sectors and the magnificent 7 stocks have yet to yield their grip over the market.

In terms of relative market performance within this segment, dividend growth outperformed during the first two months of the year, but high yield has been in control since then. Overall, the high yield and quality factors have performed better, which isn't surprising given that high yielders tend to be a little more risky and quality strategies have been overloaded with tech & growth. Dividend growth falls into the defensive category, which has struggled to pick up any momentum at all outside of a brief run for utilities earlier this year.

Economic conditions do appear to be slowly deteriorating, but a tight labor market and the prospect of 1-2 rate cuts later this year from the Fed may keep the bulls in charge a little longer.

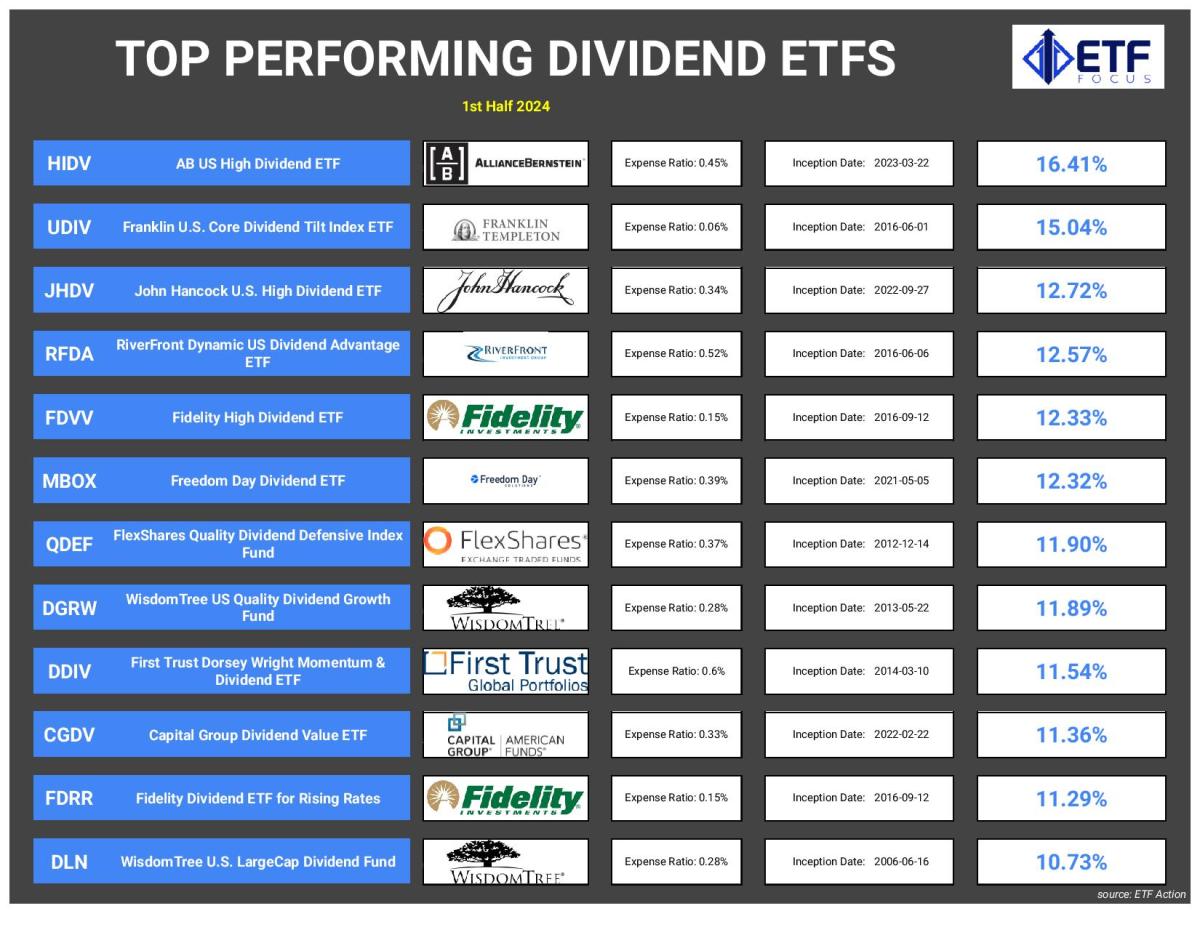

Best Performing U.S. Dividend ETFs for the 1st Half of 2024

There are a number of interesting themes to be found on this list, although very few of the big heavyweight dividend ETFs. At the bottom of the list is one of the broadest dividend ETFs in the entire marketplace, which is kind of emblematic of the U.S. stock market as a whole.

1. AB U.S. High Dividend ETF (HIDV)

This is the only U.S. dividend ETF that managed to beat the S&P 500 in the first half. You could say that the fund's active management helped because six of its top 7 holdings were magnificent 7 names with Tesla being the only exception. When you make your portfolio as top-heavy as the Nasdaq 100 in this market, the results shouldn't be surprising.

2. Franklin U.S. Core Dividend Tilt Index ETF (UDIV)

UDIV is designed to track an index of high yielding stocks, but the fund's modest 2.1% yield suggests limited success on that front. Like HIDV, its heavy allocation to the magnificent 7, which accounts for all of the fund's top 6 holdings, was the difference maker.

3. John Hancock U.S. High Dividend ETF (JHDV)

Stop me if this starts to sound familiar. JHDV is an actively-managed fund that seeks to create a portfolio of sustainable and consistent high dividend paying stocks. The fund's top 3 holdings are Apple, Microsoft and NVIDIA, combining for nearly 20% of the portfolio. These stocks certainly qualify on the sustainability factor, but all three yield less than 1%. Clearly, this is a case of buy what's working.

4. RiverFront Dynamic U.S. Dividend Advantage ETF (RFDA)

When your objective is to seek out companies simply with "the potential for dividend income", you have a lot of flexibility. Like the other ETFs above, that's led to a heavy overweight in the magnificent 7 stocks. Apparently, a lot of fund managers like this group for their dividend potential as well as growth (note: that was sarcasm).

5. Fidelity High Dividend ETF (FDVV)

FDVV is a fund that has developed a nice little track record for itself with a simple objective of seeking companies that are expected to pay and grow their dividends with a focus on higher yielders. Unfortunately, this fund has also succumbed to the temptation of the Apple/Microsoft/NVIDIA trio, although its tech weighting is at least comparatively smaller to that of the fund's above.

6. Freedom Day Dividend ETF (MBOX)

Finally, here's a dividend ETF that managed to do well in the first half without overloading its portfolio with tech stocks (and it's actively-managed, so they've consciously gone this route). While the fund does have a 16% weighting in tech, only Microsoft lands in the top 25 holdings.

7. FlexShares Quality Dividend Defensive Index ETF (QDEF)

I've been a fan of QDEF's sister fund, the FlexShares Quality Dividend Index ETF (QDF), for a while thanks to its focus on profitability, efficiency and yield. QDEF is the low beta version of that fund. The quality and low volatility characteristics of this fund make it very appropriate as a dividend holding and it works better as a portfolio diversifier.

8. WisdomTree U.S. Quality Dividend Growth ETF (DGRW)

This is quite possibly the best dividend ETF in the business and it continues to prove itself over and over. Its higher expense ratio is maybe the only thing holding it back a little at this point and it does have a fairly sizable allocation to the magnificent 7 stocks, but its long-term performance, both in absolute and risk-adjusted terms, is nearly unrivaled.

9. First Trust Dorsey Wright Momentum & Dividend ETF (DDIV)

You'd think that "momentum" would inherently mean tech in this market, but DDIV actually has relatively little tech exposure and hasn't for a while. More than half of assets belong to financials and real estate, which makes it more of a unicorn on this list and somewhat impressive in its ability to still generate a solid return.

10. Capital Group Dividend Value ETF (CGDV)

I've been hard on this ETF due its ability to include non-dividend payers in its portfolio and it was the reason it was able to own Facebook and Alphabet before they started paying a dividend this year. I'm not a fan of its looser strategy, but its tech exposure is still relative light.

11. Fidelity Dividend ETF For Rising Rates (FDRR)

FDRR is a bit under the radar, but its strategy of targeting stocks with positive correlations to Treasury yields aligns well with the current environment. Like other ETFs on this list, however, the 21% combined allocation to Apple, Microsoft and NVIDIA has undoubtedly helped performance.

12. WisdomTree U.S. Large Cap Dividend ETF (DLN)

It's kind of funny that one of the best performing dividend ETFs of the first half is one that simply targets dividend stocks broadly without any strategic tilt. If the best performing ETFs are those simply tracking the S&P 500 and Nasdaq 100, it feels appropriate that a fund, such as DLN, ends up on this list.

Reply