- ETF Focus

- Posts

- Deciphering The Current Treasury Bond Rally

Deciphering The Current Treasury Bond Rally

Is this simply an adjustment to interest rate expectations or is there a flight to safety element developing?

While Treasury bond performance has been positively pitiful since the middle of 2020, there is some magic starting to happen on the long end of the yield curve.

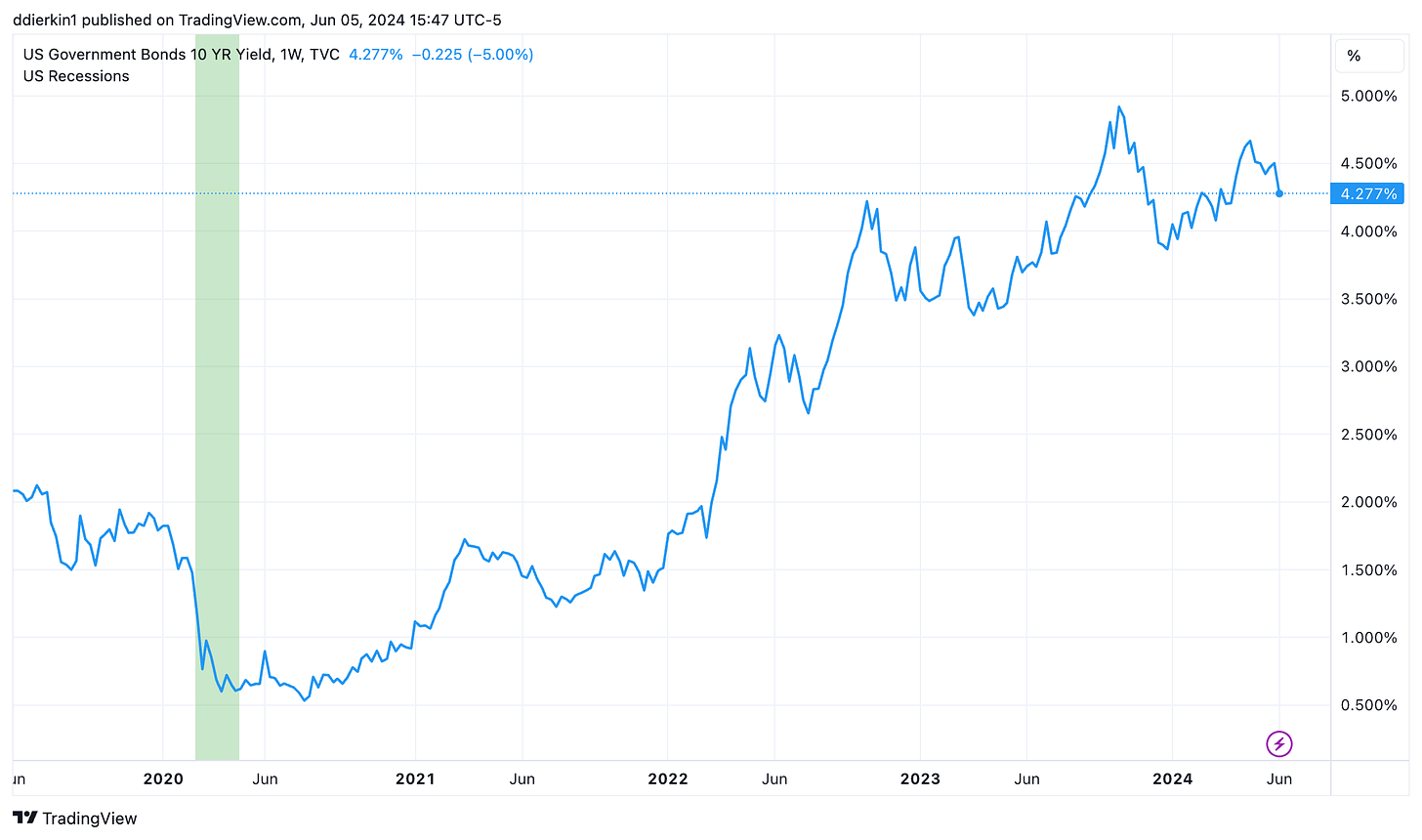

In just one week’s time, the 10-year Treasury yield has fallen by 35 basis points, translating into gains of more than 5% for the iShares 20+ Year Treasury Bond ETF (TLT).

The immediate question that investors should be asking themselves here: is this the beginning of a flight to safety trade or is it something else?

My first reaction is that we’ve seen this kind of behavior before. In fact, we saw it just a month and a half ago when the 10-year yield briefly moved above 4.7% before drifting down to around 4.3% within 2-3 weeks.

There wasn’t a lot of blatantly negative news around that time. Sure, we’ve been seeing numbers suggesting that the peak of the economic growth cycle has been behind us for a while, but there wasn’t anything specifically to make investors nervous. The markets had been trying to talk themselves into the idea of imminent rate cuts for a while, but the ECB confirming that a June cut is a done deal had the street hopeful that the Fed would join in. Thus, the May move in rates looked more like an adjustment due to changing interest rate expectations as opposed to a flight to safety.

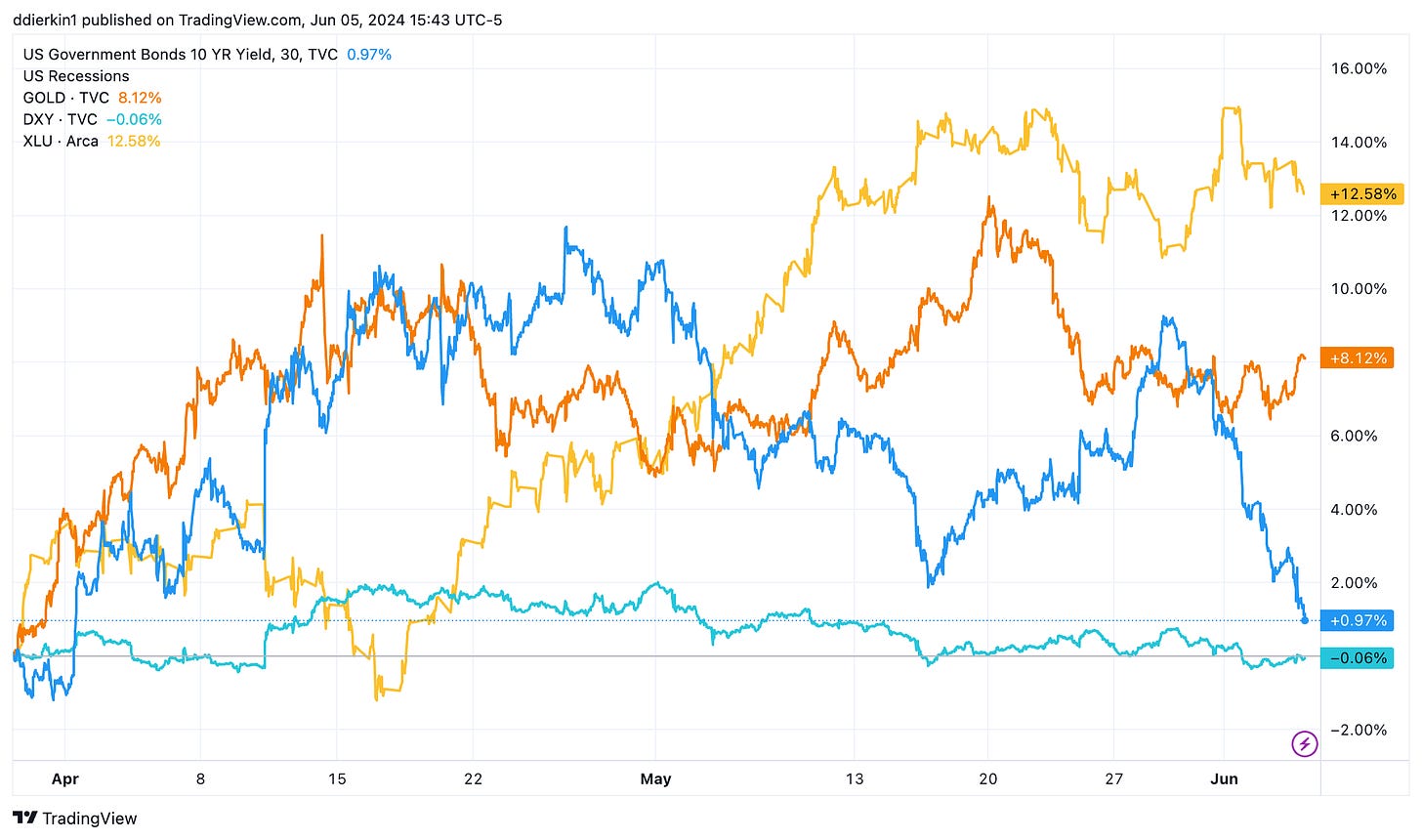

I say this despite the fact that gold and utilities had been doing very well right around that time as well. Generally, when Treasuries, gold and utilities are doing well together, it suggests that risk-off is setting in.

During the first three weeks of April, the S&P 500 experienced a 5% pullback, but by May, when Treasuries started rallying, large-caps were moving higher again. Throughout the past year and a half when stocks and bonds were making gains together, that’s been a sign that the markets are pricing in more rate cuts sooner than they were before. That’s why I’ve concluded that May was a rate adjustment, not a flight to safety.

Back to my original point, we’ve seen this kind of thing before. If we pull the telescope back to the past five years, there have been multiple instances since the pandemic where Treasury yields have fallen only to see them rise again and set new highs.

The only difference this time around (so far) is that the 10-year yield hasn’t retraced back to its earlier high. As it stands right now, it’s about 70 basis points below the level it hit back in the 2nd half of 2023. Just by looking at the chart, it appears as if higher rate momentum has fizzled out and we could be starting the slow burn back down as Fed rate cuts near.

The Case For Higher Interest Rates

There are still plenty of catalysts that could restart the higher rate cycle.

First and foremost is persistently sticky inflation. It was just last month where multiple Fed members were leaving open the possibility of another rate hike to tame re-accelerating inflation. The number that’s giving me some concern here is the core U.S. inflation rate.

While the year-over-over rate has dropped to 3.6% in April and giving many investors comfort that the disinflationary trend is in place, the latest month-over-month readings don’t suggest a disinflationary trend at all.

If you take the last 4 monthly increases and annualize it, the economy is still generating 4.4% core inflation. That’s not anywhere near where it should be for the Fed to feel comfortable about lowering interest rates, especially with the backdrop of 1-2% GDP growth and sub-4% unemployment. I don’t think the Fed will actually raise rates again unless conditions really get out of hand, but there is a decent chance that the Treasury yield curve adjusts higher to do the work for the central bank.

We can’t discount the yen situation in Japan either. The Bank of Japan has intervened twice already (that we know of) on behalf of the yen to prop it up. They need money to buy yen and we also know that they’re sitting on more than $1 trillion of U.S. Treasuries that they could use for it. If the BoJ suddenly drops billions of dollars worth of Treasuries into the open market, it would almost certainly drive up interest rates to secure buyers.

The Case For Lower Interest Rates

While the Fed may not be lowering rates to ease monetary policy conditions, they have begun to slow the pace of running down their balance sheet. Starting this month, it’s reducing the cap on the amount of Treasuries it will let mature from $60 billion a month to $25 billion a month.

While that still qualifies as balance sheet runoff, it’s an additional $35 billion that will be reinvested in new Treasuries that wasn’t before. All of that bond buying is likely to drive up the price of Treasuries to meet demand and that will in turn push rates lower.

The other factor supporting lower rates is the slowing economy. Whether it’s because of the Fed lowering rates or investors moving into safe haven assets, yields tend to fall during periods of economic uncertainty. With GDP growth already moderating, manufacturing getting weaker and consumer spending topping out, all of the pieces are in place for investors to continue shifting to defense in preparation for these changes. If this week’s non-farm payroll report comes in significantly weaker than expected (just this week, ADP employment figures came in weaker than expected and that the number of JOLTS job openings is shrinking quickly), Treasury yields could have further room to fall.

Flight To Safety or Policy Adjustment?

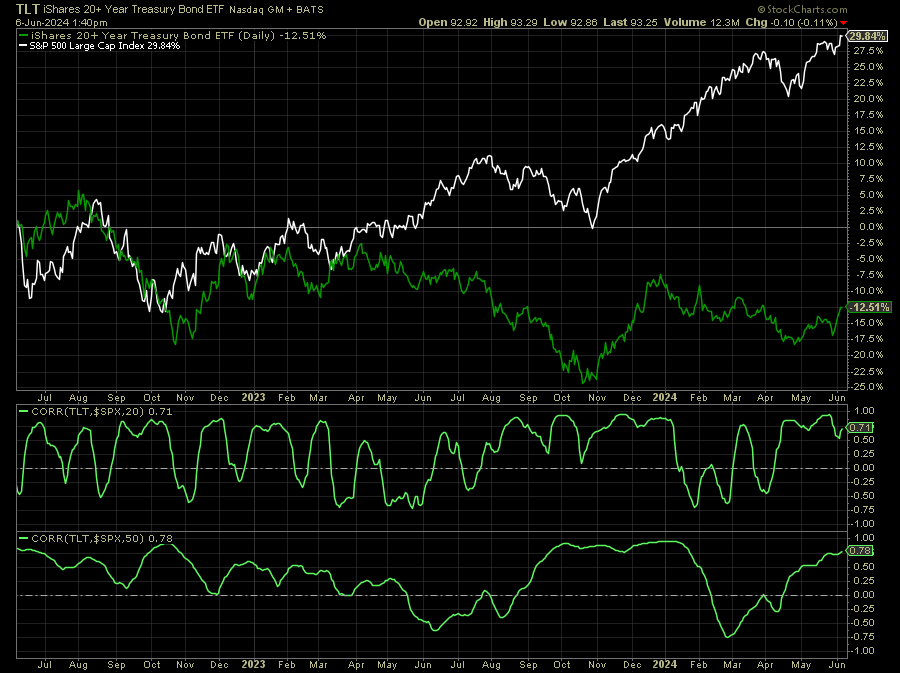

On one hand, it’s difficult to say that there’s a flight to safety happening when the S&P 500 and Nasdaq 100 are hitting new all-time highs. It just doesn’t logically make sense.

On the other hand, the best performing equity sector year-to-date (through the end of last week at least) was utilities. Gold is up 15% year-to-date and 19% from the February low. Now, long-term Treasury yields have dropped more than 30 basis points in a week and are back at two-month lows.

I think asset correlations might be telling the story here.

In Q4 2023, both stocks and bonds rocketed higher when the Fed announced it was forecasting three rate cuts in 2024 and the market went ahead to price in 6-7. That was an adjustment based on interest rate expectations.

The first half of 2024 looked more like a pure risk-on environment. Stocks were rallying hard with very little interruption, while Treasury yields drifted higher. The Fed tried to talk down over-exuberant rate cut expectations, but the economy was still strong enough to justify higher equity prices.

Over the past month or so, the correlations between stocks and bonds (short-term and medium-term) have turned sharply positive, pushing above 0.7 by both measures. If this were a pure flight to safety trade, we’d probably be seeing stock and bond prices diverging here, maybe even significantly so depending on how risk-off conditions have shifted.

But I can’t get over this nagging feeling of how long-term bond yields are plunging even though the Fed has done nothing to suggest that rate cuts are imminent. Are Treasuries rallying because the ECB and Bank of Canada have cut rates and the street thinks the Fed will obviously follow? Rate expectations have softened from around 1.5 rate cuts by year-end to 2 rate cuts, so there is some tailwind for bonds here, but it seems like there might be more at play.

Final Thoughts

Looking back at the markets over the past month or two suggests that stock and bond prices have moved based on the Fed. Over the past week or so, I think there’s a flight to safety element built in.

The rally in bonds has coincided with a slew of disappointing data - labor market, manufacturing, retail sales, personal spending, housing - and I think the bond market is taking that into account. Stocks, however, seem focused on NVIDIA and AI development more than anything and that’s causing them to overlook some of the macro fundamentals that are developing. The rally in utilities and gold that preceded the current move in long-term Treasuries shouldn’t be ignored.

The persistent lack of volatility in this market wouldn’t suggest that a correction in stocks is imminent, but I think conditions will continue to slow drift in that direction over the summer months with a potential blow-off happening in the fall.

Reply