- ETF Focus

- Posts

- Junk Bonds: Is There Value Here Or Not?

Junk Bonds: Is There Value Here Or Not?

You could argue that they're about to implode or that the Fed is going to keep their values inflated indefinitely.

While I maintain my position that Treasury bills remain the best deal in the fixed income space today (who wouldn’t want a virtually risk-free 5% yield?), there’s little question that corporate high yield bonds have been one of the best-performing segments.

Over the past year, only five fixed income asset classes have returned more than 10% - preferreds, convertibles, EM debt, bank loans and U.S. junk bonds. Of that group, U.S. junk bonds have easily seen the biggest net inflows over that time. Therefore, we could conclude that investors are leaning heavily into this group for any kind of yield above and beyond what T-bills are offering.

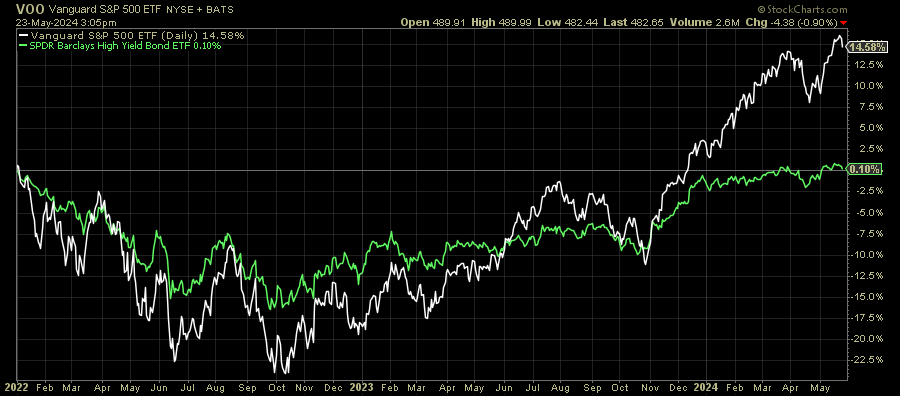

From a performance standpoint, there’s no comparison when measuring junk bonds vs. U.S. Treasuries.

Ever since the COVID recession in the first half of 2020, high yield bonds (with few exceptions) have steadily been outperforming long bonds, a trend which is still continuing today.

The economic recovery, up to this point, has backed the junk bond outperformance trend. GDP growth last year came in at 3%. The unemployment rate is still below 4%. Inflation is still running at a 3-4% annualized clip and that could eventually create some problems if the Fed is forced to keep interest rates higher for longer and issuers need to refinance debt at much higher rates than they have locked in currently.

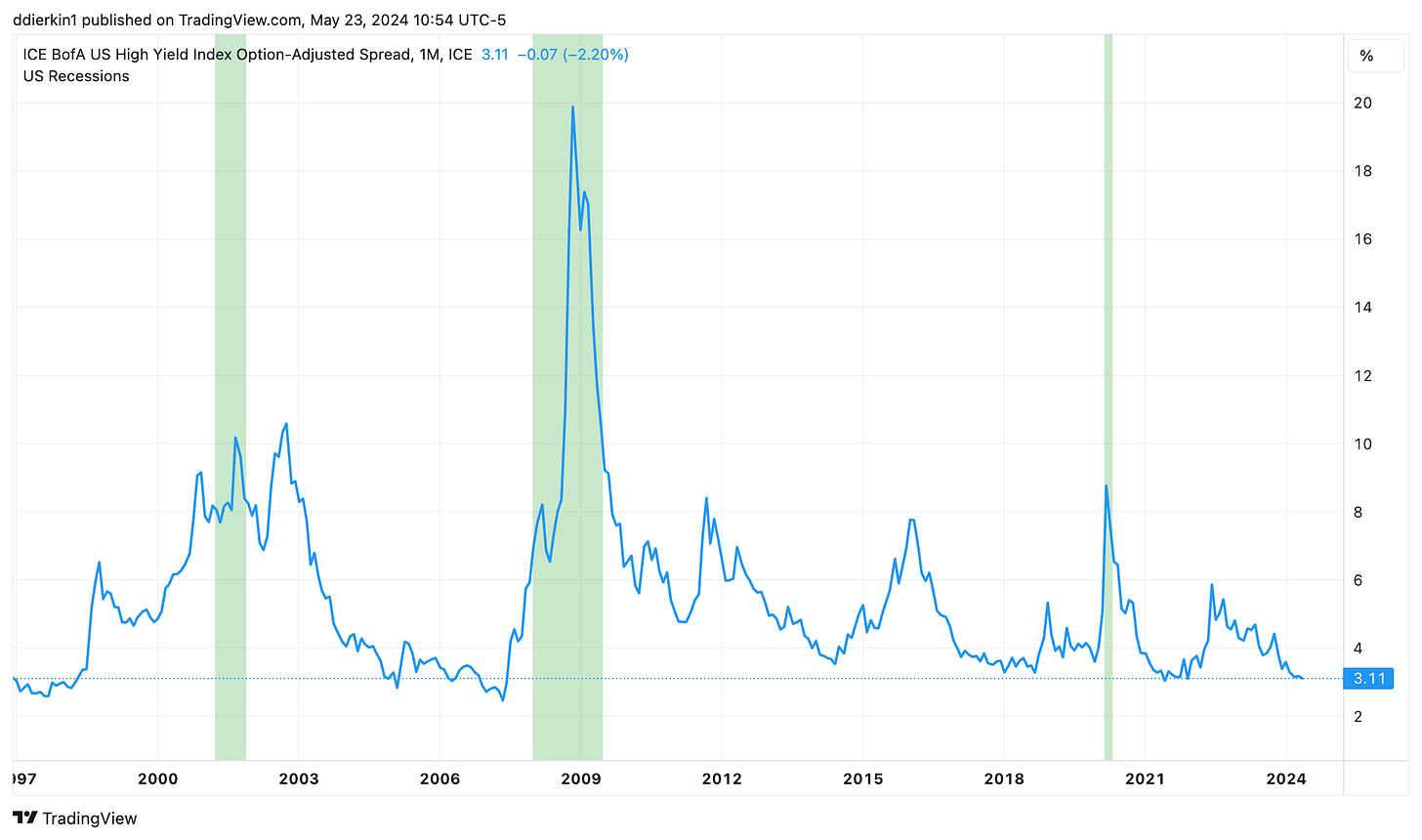

For now, that doesn’t seem like a major risk because the Fed looks like it’s going to help keep the economy afloat, even if it can’t do so via interest rate cuts. I’ve long argued that the current risk/reward trade-off in junk bonds is exceedingly negative because the group is priced for perfection. High yield spreads, which measure the premium that investors require in order to invest in lower-rated securities, are at their lowest levels in 16 years.

Admittedly, the risk of default in today’s junk bond market is probably lower than it has been previously because of not just the healthy economic backdrop, but because of the amount of liquidity still floating around in the system. The Fed has printed trillions of dollars of new money and has bloated their balance sheet to more than $7 trillion. If high yield issuers are experiencing financial stress, there’s effectively a safety net in place to help ensure that they don’t default and that’s reducing some of the perceived risk of junk bonds right now.

But to think that risk levels are at 16-year lows, at least according to junk bond spreads, is ridiculous. GDP growth slowed substantially in Q1. Corporate debt levels are still on the rise and higher interest rates are already making the cost of servicing that debt more expensive. Consumer credit card debt is more than $1 trillion and delinquency & default rates are at 12-year highs. Retailers keep warning of weakening consumer behavior. Loan growth has stagnated. You can identify all sorts of arguments about why low quality corporate debt issuers are starting to feel the squeeze.

Yet investors don’t seem terribly concerned about the risks. So which is it? Do junk bonds still have upside or are they a vastly overvalued asset class?

Junk Bonds Have Delivered Far Superior Risk-Adjusted Returns

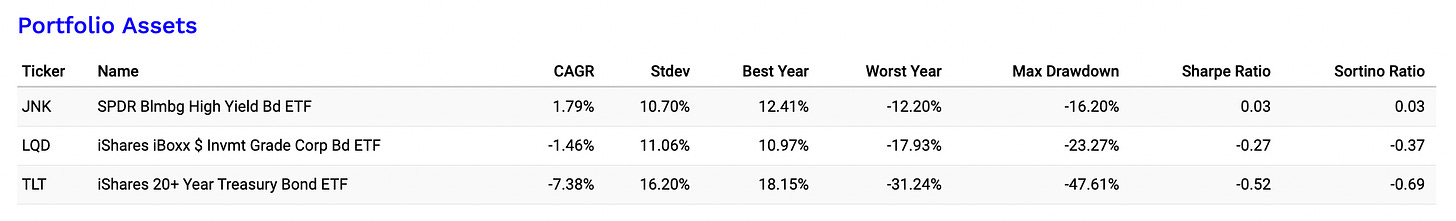

Looking at the 5-year performance chart I included above, it probably wouldn’t surprise you that junk bonds have delivered superior risk-adjusted returns. The magnitude of outperformance, however, may.

source: Portfolio Visualizer

Not only have junk bonds beaten both investment-grade corporate bonds and Treasuries, they’ve done so with less risk. Their maximum drawdown has been far less than both categories and its Sharpe and Sortino ratios are much higher. You can go back to the start of the financial crisis even and see the same trend play out. In the fixed income space, junk bonds have been the best investment going back nearly 20 years.

But here’s the million dollar question today: Is the monetary easing and added liquidity the Fed wants to unleash enough to outweigh the macroeconomic risks facing the economy?

QT Is Easing And May End Altogether Soon

The Fed meeting minutes released earlier this suggest that the Fed may choose to keep interest rates higher for longer, but it also announced that it was going to begin dialing back its current balance sheet runoff. Essentially, one dial might remain tighter, but another is loosening. The net effect is unclear, but what is clear is that the Fed really seems to want to pivot towards a more accommodative stance. Keeping rates high can’t paint the picture that the Fed is going to do everything it can to bring inflation down, but slowing down balance sheet runoff helps the ultimate focus on achieving the soft landing.

Here’s what we know about the Fed’s plans for QT:

source: Bankrate

Technically, the Fed will still be running down the balance sheet, but $35 billion that would have been allowed to run off previously will instead be reinvested into new Treasuries. In other words, this is likely the first step towards a broader monetary policy shift towards easing over tightening.

Let’s add some context around this.

The Fed's balance sheet grows when it purchases securities, typically as part of its monetary policy operations to lower interest rates and stimulate the economy. This process is known as quantitative easing. Conversely, balance sheet runoff, or quantitative tightening, occurs when the Fed allows these securities to mature without reinvesting the proceeds, thus reducing its balance sheet.

Slowing the runoff means the Fed is reducing the pace at which it is withdrawing liquidity from the financial system. This can be seen as a more accommodative stance, providing more support to the economy by keeping more money circulating. It may help in maintaining lower interest rates or preventing them from rising too quickly, which can be beneficial for borrowing and investment.

Slower runoff can boost investor confidence as it signals the Fed is cautious about tightening financial conditions too quickly, potentially leading to more stable or rising asset prices. More liquidity in the market can support higher asset prices, including stocks and bonds, as there is more money available for investment. It indicates a shift in the Fed's monetary policy stance, suggesting that the central bank is responding to economic conditions that may require a less aggressive reduction in its balance sheet.

Does the Fed think that conditions are such that there’s a need for more liquidity in the system? Is it expecting a global economic slowdown? Does it see risks rising and is it taking a preventative measure to ensure that there are enough reserves are available to prevent a larger crisis from occurring?

It’s possible, but as it pertains to junk bonds, added liquidity is a good thing. Issuers with questionable credit credentials need the added flexibility to ensure their ability to continue operating and this will, at a 30,000 foot level, improve financial conditions for these companies.

Liquidity Is King

If there’s one thing that we’ve learned over the past two years, it’s that the markets react very positively to the idea of loosening financial conditions. Just look at a chart of the S&P 500 since the beginning of 2022 and you’ll have no problem pinpointing the instances where investors began buying into the Fed pivot narrative.

Junk bonds, obviously, didn’t have quite as strong of a reaction, but their behavior definitely correlated with that of stocks and the expectations for monetary policy conditions.

In this case, even though interest rates are likely to remain higher for longer, I believe the Fed will more than offset that by adding liquidity back into the system. Eventually, I think QT will end altogether and the Fed will officially return to an accommodative policy stance.

I remain convinced that risks in the junk bond market are much more elevated than in the past, but I think monetary conditions over the next 6-12 months will shift enough that there will be more value that could be squeezed out of these bonds.

Junk Bond ETF Marketplace

Currently, there are 71 high yield bond ETFs available, managing more than $73 billion.

The largest are the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the iShares Broad USD High Yield Corporate Bond ETF (USHY), both with more than $10 billion in assets.

There are currently plenty of options if you want to capture a yield north of 7%, but risk gets much higher once you start looking at an 8.5% yield or higher. In general, broader focused funds with higher liquidity and lower fees are preferable.

Several options exist with expense ratios below 0.10% with the lowest being the Schwab High Yield Bond ETF (SCYB) at 0.03%.

In my high yield bond ETF rankings, which are driven by a number of quantitative factors, the top 3 are:

Xtrackers USD High Yield Corporate Bond ETF (HYLB)

Schwab High Yield Bond ETF (SCYB)

iShares Broad USD High Yield Corporate Bond ETF (USHY)

Reply