- ETF Focus

- Posts

- What You May Have Missed This Week...

What You May Have Missed This Week...

The "new look" SCHD, the best dividend ETF you've never heard of and why the Fed is helping retirement income seekers!

In addition to the regular posts here, I also publish ETF research and notes over on my blog, ETF Focus over at TheStreet.com.

In case you wanted to catch up on the latest research above and beyond what you’re reading here, this is a quick list of some of the most recent articles from the blog!

Let's Talk Retirement! The Fed May Be Giving You A Gift Right Now!

Inflation has begun trending in the wrong direction again and I believe that the Fed will turn hawkish again before it ever gets to three rate cuts. My base case expectation is for two rate cuts by year-end. I think we could be headed into a prolonged period of “higher for longer” when it comes to interest rates. That could ultimately prove to be a negative for stocks or perhaps long-term bonds.

Who it should not be considered negative for is those generating income from their portfolios, especially retirees.

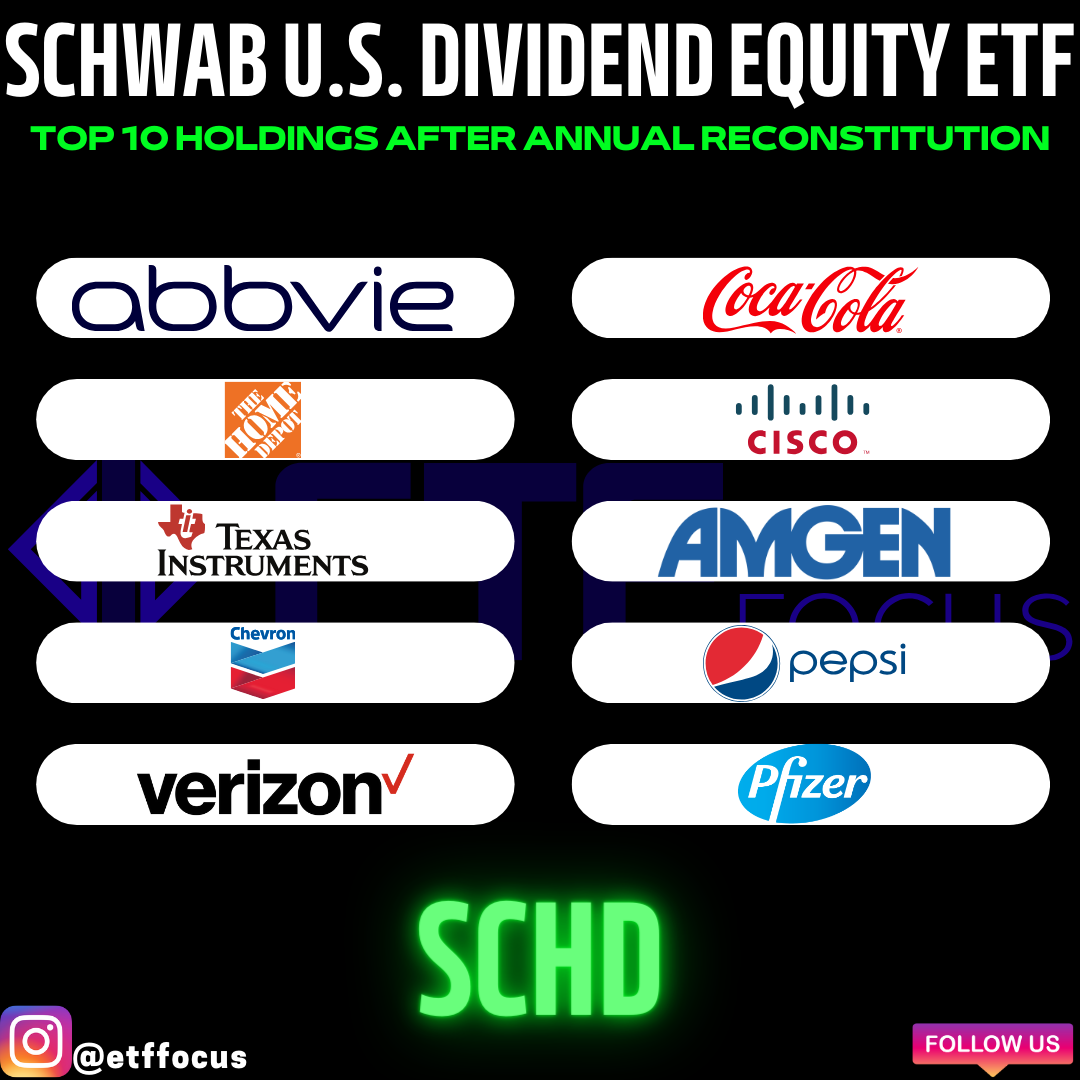

Schwab US Dividend Equity ETF (SCHD) Annual Reconstitution: 23 New Names; HD & VZ New In Top 10; AVGO & MRK Out

The Schwab U.S. Dividend Equity ETF (SCHD), the 2nd largest dividend ETF in the marketplace behind only the Vanguard Dividend Appreciation ETF (VIG), just completed its annual reconstitution.

It may not seem like a terribly exciting event, but it's the one time of year where the fund turns over a fairly sizable chunk of its portfolio. This time around, there are 23 additions/deletions to the portfolio, which is quite a lot for a fund that only holds around 100 names to begin with.

Is This The Best Dividend ETF You've Never Heard Of?

With the tech trade showing signs of exhaustion and other areas of the market beginning to replace it as a performance leader, it's allowed some under-the-radar dividend ETFs to rise up the performance ranks. A few, however, have been delivering for several years even as the magnificent 7 stocks dominate the landscape.

One such ETF is the Freedom Day Dividend ETF (MBOX).

High Yield Income from Covered Calls on Technology Stocks: 3 ETFs to Watch

A useful guideline to remember is that typically, the more volatile the underlying asset, the higher the distributions from a covered call ETF can be. This relationship stems from the way volatility influences options premiums.

For investors aiming to maximize income, turning to covered call ETFs that focus on the technology sector, as well as companies in related areas like consumer discretionary and communications—think big names like Amazon, Tesla, Alphabet, and Meta—can be particularly lucrative. These sectors are known for their high volatility, making them prime candidates for covered call strategies.

A Close Look at Roundhill's New Bitcoin Covered Call ETF

The cryptocurrency market is witnessing another bull run, with Bitcoin's price soaring to $67,484 USD on February 4th, buoyed by the anticipation of the upcoming halving in April and bolstered by significant inflows into 11 new spot Bitcoin ETFs.

But amidst this backdrop of excitement and growing investor interest in cryptocurrencies, there's been notable innovation within the ETF space as well.

Two Important Things You Need to Know Before Buying and Holding a Leveraged ETF

Bull markets have a way of enticing new retail investors into making decisions that might not be in their best interest. The lure of quick profits and the stories of overnight success can lead to some questionable, even downright stupid investment strategies. Among the myriad examples shared on platforms like Reddit, a few stand out.

Two High-Yield Income ETFs That Have Been Flops So Far

Whether you're focused on generating income through investments or seeking growth opportunities, I think there's a common ground that unites us all: the significance of total returns.

To put it bluntly, it really doesn't matter if your profits are stemming from dividend payments, covered calls, share buybacks, or share price appreciation. At the end of the day, what we all desire is to see our investment line trend upwards over the long term.

This principle holds true even for income investors. Sure, the allure of high-yield income ETFs is undeniable, offering the promise of steady income streams. However, it's crucial to evaluate these investments based on their total returns.

Betting on Sports Betting with BETZ

You can’t turn on a sporting event on the TV without seeing an endless drowning of advertisements for sports betting from companies like Draft Kings or Fan Duel. Sports betting has been around for a long time—dating back to even the 18th century—when participants would make formal bets on horse racing.

As of the time of writing, there are more than 30 states that have legalized sports betting. When you combine this with the internet, smartphones, social media, and applications—it’s never been easier to place an online sports bet.

3 Best Invesco ETFs of 2024

When the name "Invesco" comes up in investment circles, many immediately think of QQQ, the flagship Nasdaq 100 ETF renowned for its substantial growth, with $249 billion in assets under management. Today, QQQ has become synonymous with tech-heavy investment strategies, offering significant exposure to the largest non-financial companies listed on the Nasdaq stock market.

However, concentrating solely on QQQ means overlooking the diverse range of ETFs that Invesco offers, each with unique strategies and potential benefits for investors. Beyond the behemoth that is QQQ, Invesco boasts a wide array of ETFs covering various sectors, themes, and investment approaches.

Reply