- ETF Focus

- Posts

- The New Reality: Rate Cuts Are Not Coming

The New Reality: Rate Cuts Are Not Coming

In my opinion, there is no reasonable justification that the Fed can make right now for cutting interest rates.

It was only a couple of months ago that the markets were on a Fed high. In December, Powell officially announced that the Fed was building rate cuts into the forecast and investors were off to the races.

But there was a normal market response and there was a lunatic market response.

In the 1st quarter of 2024, the S&P 500 was up 10%, a strong quarter by almost any measure. Equities love the idea of looser financial conditions and lower interest rates. The idea of lower borrowing rates with the backdrop of existing strong economic growth pushed stock prices higher, especially cyclicals.

Then there was the irrational. Even though Powell’s dot plot report showed three cuts forecasted by year-end, the markets almost immediately priced in 6 cuts. At one point in January, the futures market gave a 20% chance of at 10 cuts in 2024!

To say that the markets were overconfident and way out over their skis would be a massive understatement. It was clear from early on that the markets would need to unwind some of these rate cut expectations and they did starting around the end of January. It’s been a slow journey, but by March the markets had mostly gotten back in line with the Fed at three rate cuts for 2024.

But there was a problem. At that point, the Fed’s official forecast had become stale. Inflation looked like it was turning higher again and the traditional economic indicators, such as GDP growth, retail sales and manufacturing activity, were actually picking up. Many of the common measuring sticks were giving inflationary, not disinflationary, signals. This was an important change because the Fed’s rate cut forecast was predicated on the disinflationary trend continuing throughout the year and eventually arriving back at the 2% target.

But that wasn’t happening. As the U.S. economy began to heat up again, the market’s expectation case for rate cuts started to dissipate.

So imagine my surprise when Powell actually took the opportunity to reiterate the Fed’s three cut forecast in March! Did Powell know something that the market didn’t? This was around the time that the yen/dollar rate was breaking through the 150 level where the Bank of Japan has traditionally intervened to support it. Were central banks of the belief that something was wrong and they planned on making a preemptive strike to get in front of it? It would certainly be out of character for central banks to actually be in front of the curve instead of behind it, but I suppose it’s a possibility.

We still don’t know for sure, but we do know that Powell has finally turned more hawkish since. At a speech just recently, he said that progress on inflation had stalled, backed off on giving any forward rate guidance and said restrictive policy needed more time to work.

Translation: rate cuts are not coming!

In my opinion, there is no reasonable justification that the Fed can make right now for cutting interest rates. The data doesn’t support it. The trends don’t support it. The where growth, consumer behavior and activity are at right now, the economy is not in need of a boost to get it going. It’s already going and going pretty strongly. When comparing economic growth and inflation, inflation is by far the greater issue facing the U.S. economy right now.

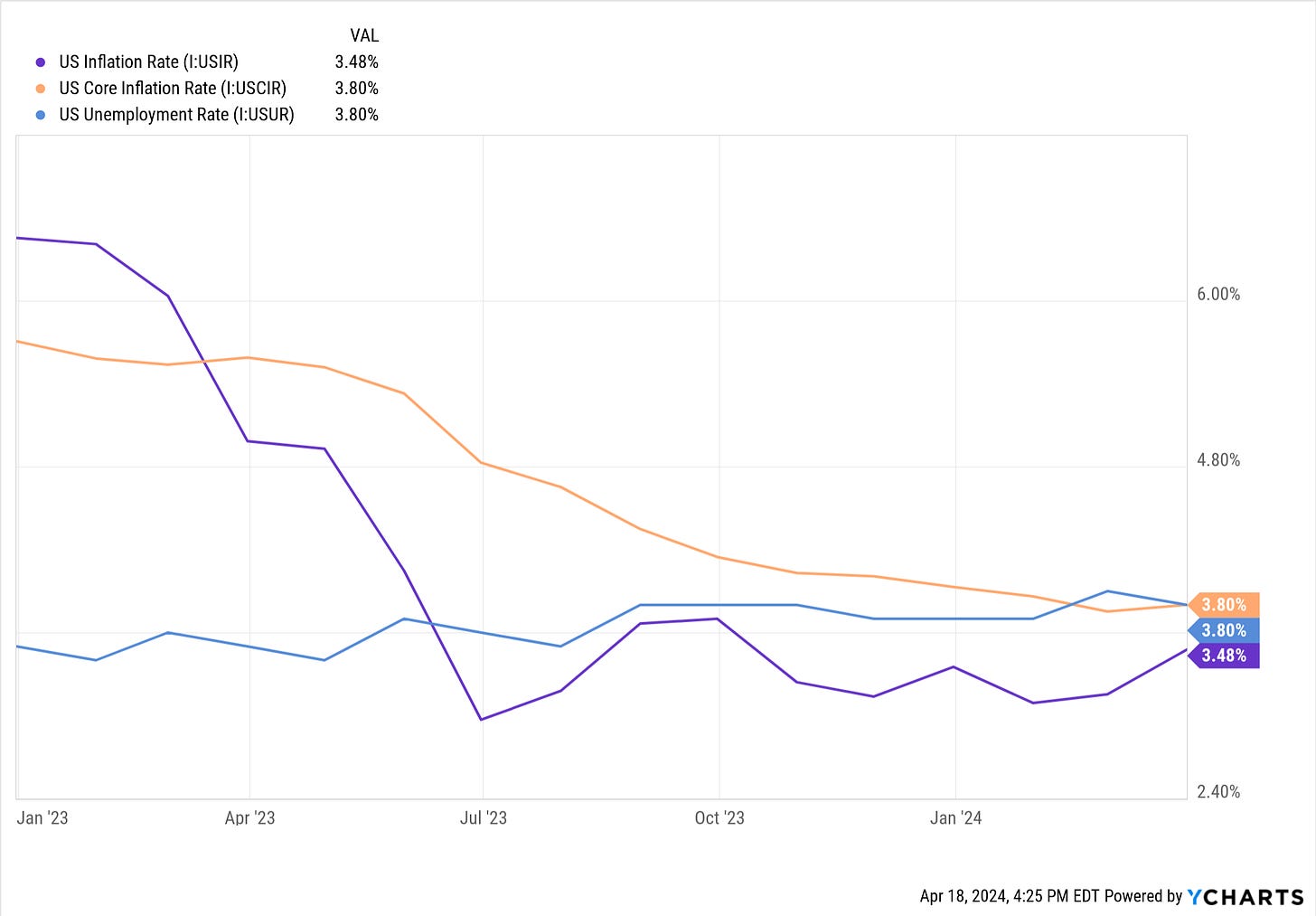

Think of it this way. Inflation is at 3.5%, a full 0.6% higher than its recent low. Core inflation is at 3.8% and trending above 4% on a short-term annualized basis. The unemployment rate is under 4%. The GDP growth rate in 2023 was 3.1%. Does that sound like an economy that needs assistance from the Fed? The answer is a resounding no!

This is simply not the point where a central bank should be cutting interest rates, especially with some key figures trending in the wrong direction. If we were in a situation like Brazil where their central bank had to raise its benchmark rate well into the double digits to get inflation under control, then maybe there’s some justification for at least normalizing somewhat even if the job isn’t complete.

But the Fed Funds rate is still in the 5.00-5.25% band, which isn’t egregiously high, especially considering that higher interest rates really haven’t slowed anything down. There’s nothing really to “normalize” here, which, in my opinion strengthens the case for no rate cuts.

That hasn’t stopped the markets from still pricing in rate cuts.

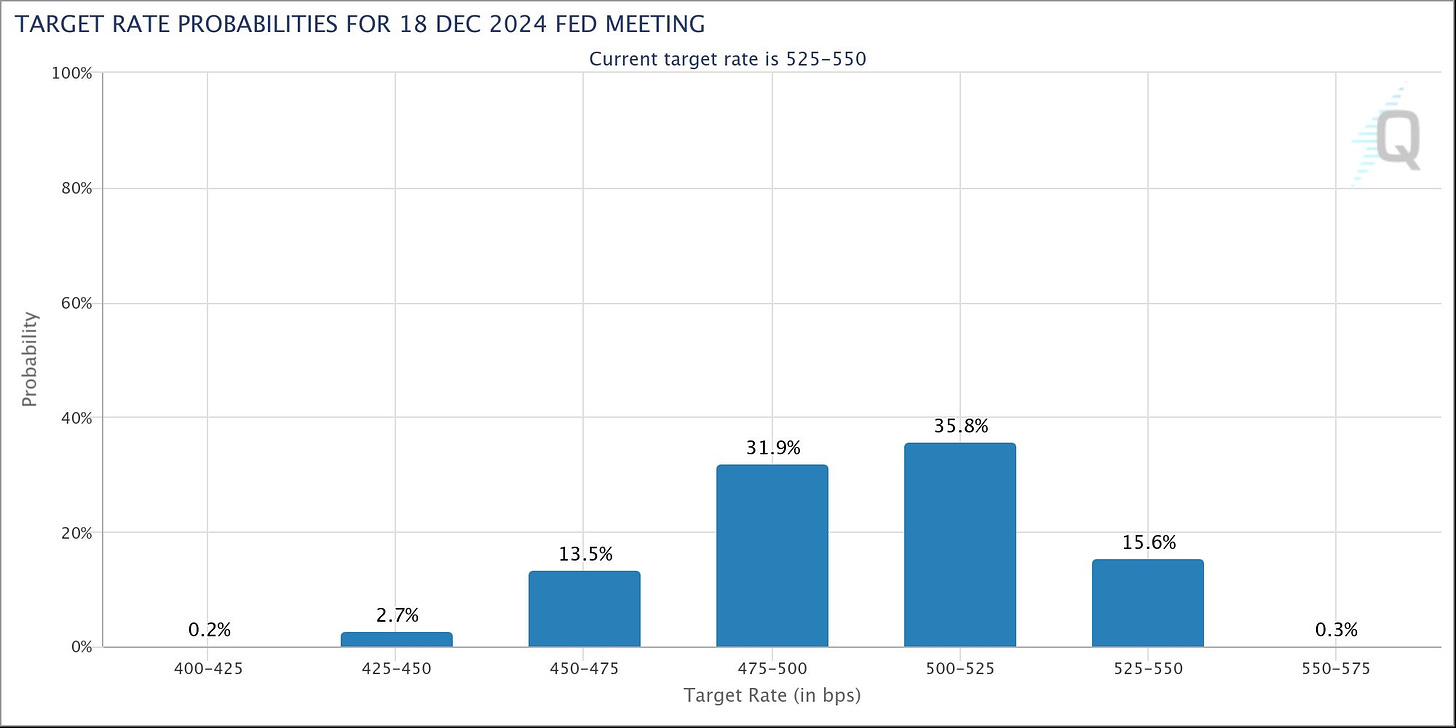

The overall expectation has gone from 6-7 down to 1-2 with just a 16% likelihood of no rate cuts in 2024. That at least seems reasonable, although I personally think there’s a much lower chance than 84% that the Fed cuts at some point this year. There are only five more meetings left in this calendar year, it becomes pretty clear that there is really only one, maybe two, real opportunites where a rate cut might legitimately be on the table.

Given Powell’s recent comments, here’s what we’re looking at in 2024.

May 1, 2024 - No chance. Powell just said it’ll take more time and two weeks definitely isn’t enough.

June 12, 2024 - Very little chance. It’s really tough to take Powell’s recent comments at face value and think he’ll turn around less than two months later and cut rates. The Fed will get two more inflation reports before this date and that won’t be nearly enough data for Powell to think that the disinflationary trend is firmly back in place.

July 31, 2024 - Maybe? If we get three months of data showing that things are cooling off and inflation is heading lower again, Powell might say “close enough” and push for a single preventative rate cut. There’s no way the Fed goes for a “cut every meeting” plan, so a “cut and pause” plan might be a good alternative. It moves for a modest loosening and then reassesses later.

September 18, 2024 - Probably unlikely. This is two months before the presidential election and, as much as I’d like to believe that the Fed can act independent of political events, I don’t think they’ll do anything this close to the election. It’ll be for the appearance of impartiality if nothing else.

November 7, 2024 - Nope. This is just two days after the election. If the 2020 election is any guide, anything could be happening in the United States at this point. With the December meeting just over a month away, I imagine the central bank will be happy to sit this one out.

December 18, 2024 - The highest likelihood. The political calendar will be clear. The Fed will have plenty of new data to work with. If a disinflationary trend has returned and/or the economy has slowed, the Fed could pull the trigger here. There’s a lot that could happen between now and then, but this is a best guess based on what we know now.

I think there’s one real opportunity for a rate cut in 2024 and that’ll come just before Christmas, a full 8 months from now. Probably not what investors want to hear, but I think it’s the most likely outcome.

Now, there are a lot of wild cards that could come into play here. War in the Middle East. A currency blow-up in Japan. Recession in China. A further re-acceleration of inflation. If the bottom falls out with respect to any one of these factors, Powell and company to choose to act quickly and decisively, much like they did at the onset of the COVID pandemic. If something like that were to occur, everything I just wrote will probably age pretty poorly and fast!

Closing Thoughts

I’m not nearly as dovish as many folks when it comes to rate cut expectations, but the path I just laid out and the reasoning behind it, I believe, is very reasonable.

Based on the totality of economic data available to us right now, I just don’t think there’s a case for the Fed to be considering rate cuts. In reality, I think the odds of a rate hike should be higher than those for a rate cut, but I don’t think that’ll even be considered unless something REALLY goes wrong with inflation.

No rate cuts in 2024. This, in my opinion, is our new reality.

Reply