- ETF Focus

- Posts

- The 4 Dividend ETFs That Have Beaten The S&P 500 This Year: What's Their Magic Formula & Can It Continue To Work?

The 4 Dividend ETFs That Have Beaten The S&P 500 This Year: What's Their Magic Formula & Can It Continue To Work?

Why have they succeeded where so many others have failed?

Quickly identify market opportunities w/ the #1 A.I. for asset selection.

With the S&P 500 (VOO) and the Nasdaq 100 (QQQ) both up well over 20% this year and the magnificent 7 stocks (MAGS) collectively up more than 40%, it’s probably not surprising that dividend stocks have been underperformers. After all, who really wants a defensive portfolio with a paltry 2-3% yield when you can simply buy the market and get 25%?

It hasn’t been a clean sweep for tech and growth stocks though. The broader tech sector (XLK) is actually lagging the S&P 500 year-to-date. The best performing sector, strangely, is utilities (XLU), up more than 30%. The market has broadened out beyond just the mega-cap tech names as the year has progressed and that’s opened the door slightly for other strategies to capture returns.

Dividend ETFs have had a modest degree of success in 2024, although not really when it comes to measuring up against the S&P 500. Dividend stocks did relatively better when cyclicals began leading the way in the 2nd half of the year. Correspondingly, high yield strategies, which generally include larger allocations to cyclicals, did better than more defensive strategies. The leadership from utilities didn’t provide as much of a boost as you might think.

Overall, it was a decent but not good year for dividend stocks. A few of them, however, have managed to beat the S&P 500. Four of them to be specific. What’s been their secret sauce? Why have they succeeded where others have failed? More importantly, can it continue from here?

Let’s take a look at these four ETFs to see what made them tick in 2024.

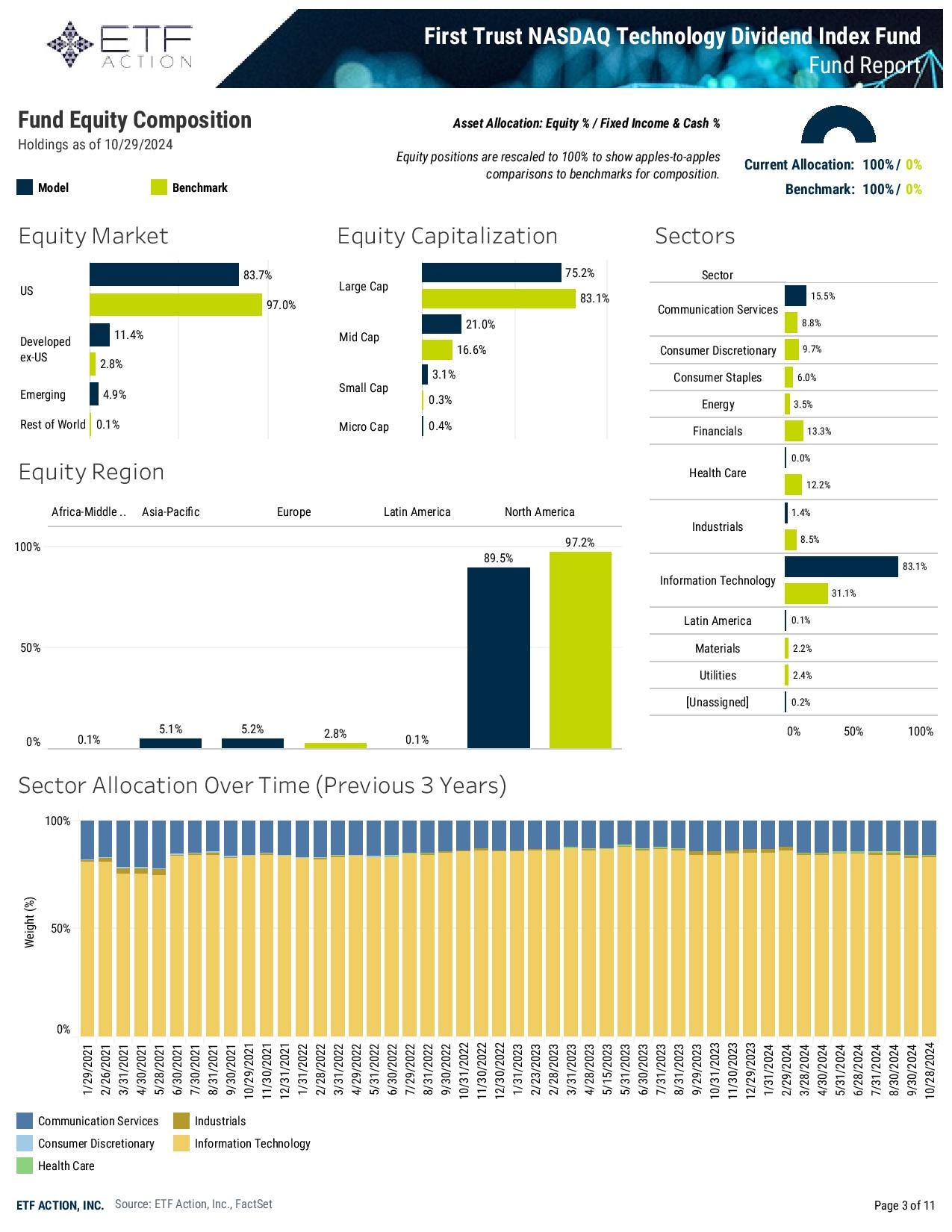

First Trust Nasdaq Technology Dividend Index ETF (TDIV)

Why It’s Worked: Tech Exposure, Specifically From Large-Caps

It shouldn’t be surprising that with tech performing so well over the past year and most ETFs heavily weighted to tech stocks that tech dividend ETFs are among the leaders.

If you’re expecting a magnificent 7 style ETF here, you’ll be disappointed. The big dividend payers in this sector are the older, stodgier names, such as Oracle, IBM and Texas Instruments. TDIV does have Microsoft among its top 5 holdings, but this won’t be the high growth vehicle that you might think it is given its association with this sector (TDIV is about 15% less volatile than XLK).

The fund did benefit from its concentration though. The quintet of Oracle, Broadcom, Microsoft, IBM and Texas Instruments account for about 40% of the portfolio. Four of the five names beat the S&P 500, including Broadcom & Oracle, which have gained 60%+ a piece. The lone underperformer, ironically, is Microsoft.

What’s The Outlook: More Of The Same?

The current data doesn’t really support the idea of an imminent economic downturn, so this ETF could be positioned to pretty much keep doing what it’s already doing, which is to likely underperform the broader tech sector, but be among the top dividend ETFs.

If things do turn south, I imagine tech will get hit pretty hard, but the more durable quality of many names in this fund could hold up better.

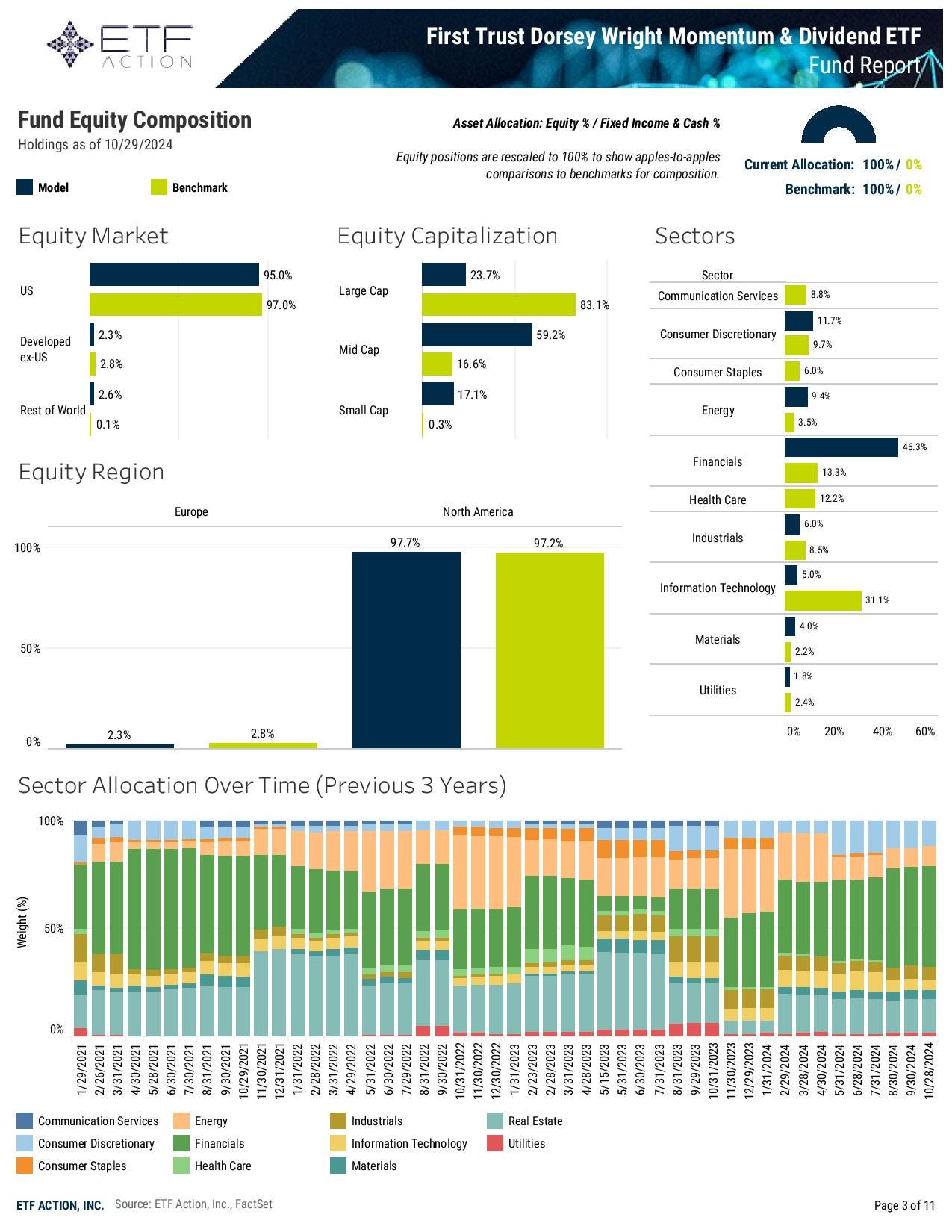

First Trust Dorsey Wright Momentum & Dividend ETF (DDIV)

Why It’s Worked: Momentum Factor & Overweight To Financials

You could give an honorable mention to the fund’s yield weighting strategy, which tipped things in the right direction, but portfolio positioning was everything.

Financial stocks (XLF) have been a big part of this fund for the past year and its allocation grew larger right when cyclicals started picking up. Financials are now the 2nd best performing sector of the year and the momentum factor (MTUM) has gained more than 40% on the year.

The use of a momentum strategy has been beneficial this year, pivoting away from sectors when they’re fizzling and adding to them as they’re rising. The allocations to energy and real estate, which are two of the fund’s three largest sector holdings, haven’t been particularly helpful, but the fund has done a good job of being in the right place at the right time.

What’s The Outlook: Depends On The Soft Landing

If the soft landing happens and we move into an extended period of expansion, the outlook appears positive. Right now, more than 70% of the fund’s portfolio is in the combination of financials, energy and real estate. All three of those are very cyclically sensitive areas of the market that should do well in a cyclical reflation. If something, such as the labor market, breaks down quickly, it could be in trouble, but the momentum strategy should help it down the road.

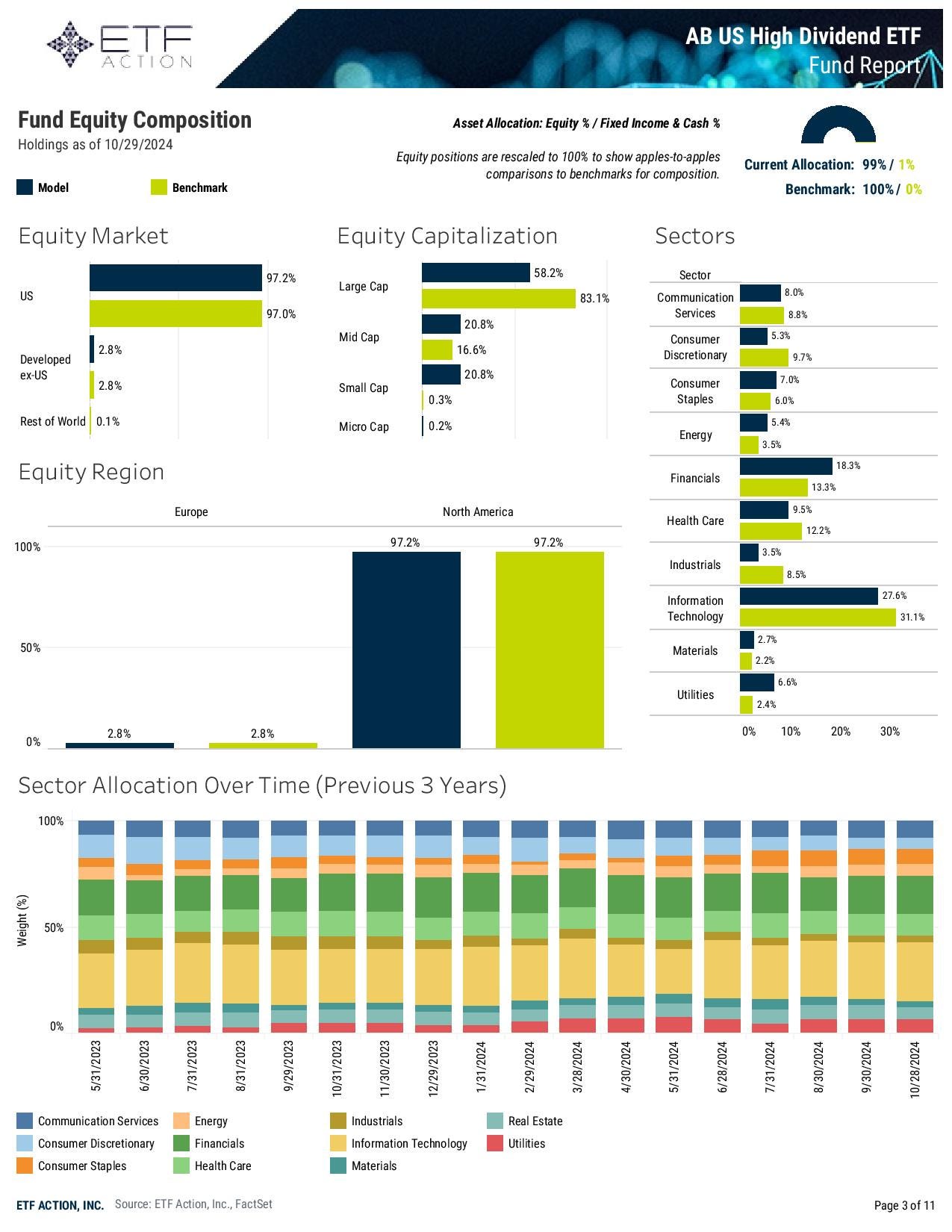

AB U.S. High Dividend ETF (HIDV)

Why It’s Worked: The Magnificent 7

Here’s where it pays to read the fine print. In the fund’s prospectus, we find that it has quite a bit of leeway in what it can invest in.

“While its emphasis is on investing in companies that currently pay a dividend, the Adviser may also invest in non-dividend paying companies.”

This is blatantly evident when looking at the top holdings, which include Apple, Microsoft, NVIDIA, Alphabet, Amazon, Facebook and Netflix among its top 8 positions. Netflix and Amazon don’t pay a dividend. Alphabet and Facebook just started paying a minimal dividend within the past year. NVIDIA has a dividend yield of 0.03%. Sound like a dividend ETF to you?

At best, this is loosely a dividend ETF. This is a case where the fund’s managers have taken advantage of very liberal selection criteria and used them to chase the market’s biggest winners. For me, this is a disqualifier. If I’m investing in a dividend ETF, I want dividend stocks, not kinda/sorta/mostly dividend stocks.

What’s The Outlook: Good If You Think The Mag 7 Will Keep Leading

This fund is actively-managed and, given its history, it seems likely that it will keep chasing whatever is performing best at the moment. With a 57% active share, the fund is doing an OK job at not being an index fund, but the top holdings don’t paint a flattering picture.

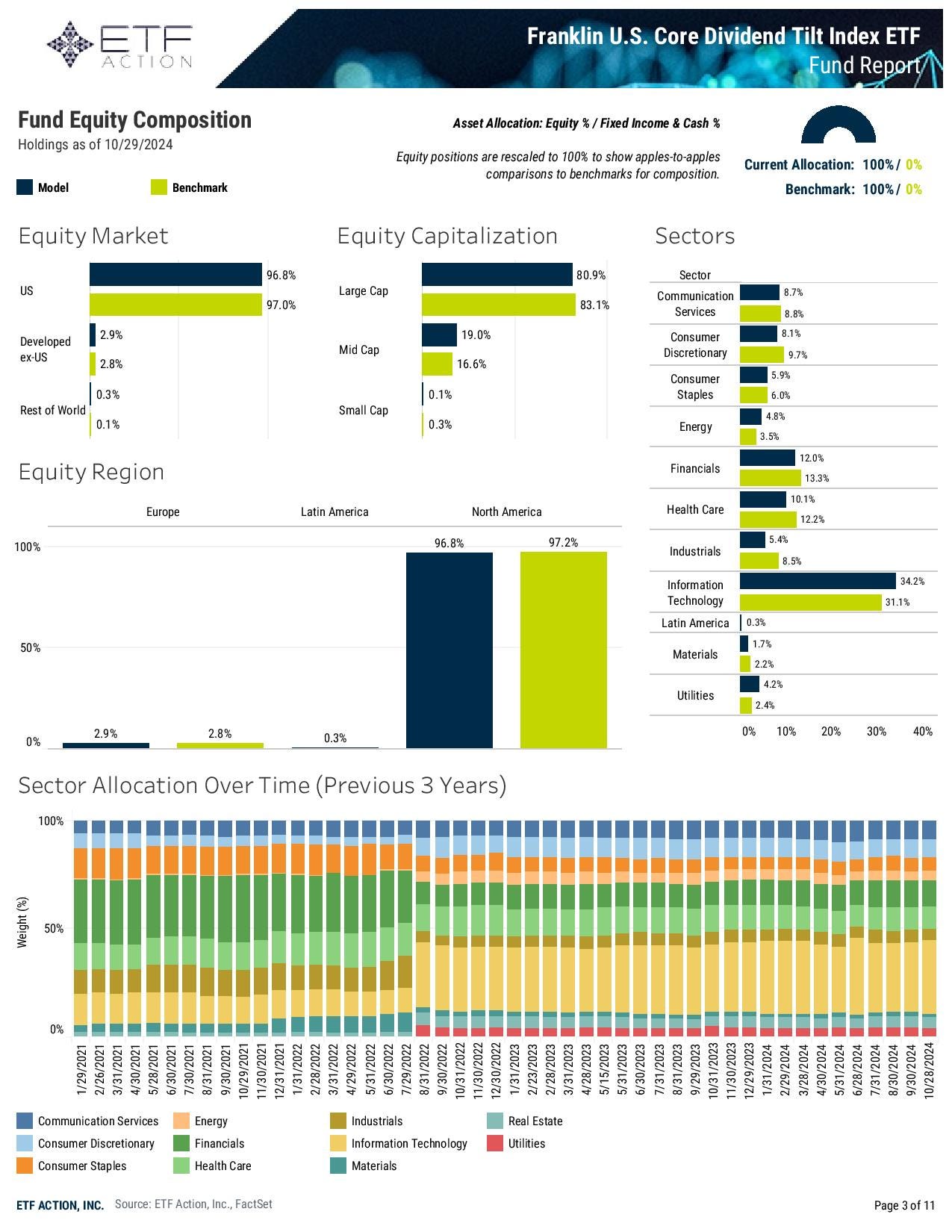

Franklin U.S. Core Dividend Tilt Index ETF (UDIV)

Why It’s Worked: The Magnificent 7

This may sound like a broken record, but this is pretty much a repeat of HIDV. The top 6 holdings are all magnificent 7 names, including the aforementioned non-dividend paying Amazon, accounting for roughly 30% of the portfolio. Another non-dividend payer, Tesla, comes in at #13.

Much of the rest of the portfolio is invested in more traditional dividend-paying stocks, but it’s heavily tilted towards growth sectors and high yielders, such as the financials and big energy names.

What’s The Outlook: Again, Great If You Think The Mag 7 Will Keep Leading

At the risk of repeating myself again, this is more of a quasi-tech/growth ETF with a modest dividend tilt than a true dividend ETF. I suppose it’s right there in the fund’s name, but I’m not fond of ETFs that play it loose with selection criteria.

Final Thoughts

For me personally, I wouldn’t consider HIDV and UDIV to be “true” dividend ETFs (I’d throw the Capital Group Dividend Value ETF (CGDV) into this bucket as well since it also allows for the inclusion of non-dividend payers). If you’re going to invest in a dividend ETF, you should get one with dividend stocks, not one that’s mostly dividend stocks.

TDIV, obviously, has benefited from the performance of the tech sector, but I find DDIV intriguing. The momentum piece of its strategy allows it to remain nimble and follow what’s been working well. The heavy cyclical & real estate exposure is a bit unusual relative to the rest of the dividend ETF universe, but it makes sense.

If there’s one thing this exercise should teach you it’s that you should always look under the hood of what you’re buying. It’s not unusual to find a nasty surprise or two inside.

Reply