- ETF Focus

- Posts

- The Markets Seem Happy About The Fed's Rate Cut; They Shouldn't Be

The Markets Seem Happy About The Fed's Rate Cut; They Shouldn't Be

Investors continue to ignore the risks being presented to them.

We knew the Fed was going to cut interest rates on Wednesday. The only question was by how much.

The markets had mostly priced in a quarter-point cut until about a week ago. That’s when people, including former Fed voting member Bill Dudley, began floating the idea that a half-point cut was more than justified given conditions (Dudley went as far as to say that there was a “strong case” for it).

I had argued that a quarter-point move was the way to go. It would have represented a gentler and more controlled launch to what was going to be a lengthy easing cycle. A half-point cut on the other hand might send the message that the Fed had either fallen behind again or that conditions were worse than thought.

Then, the markets did this.

Stocks popped immediately after the announcement, but slowly gave it back during and after Powell’s press conference. Thursday morning, however, all seemed good again! Growth, high beta and tech were roaring. Defensive themes, such as utilities, consumer staples, low volatility and value, turned to laggards. Treasury yields rose, although gold managed to hang on to its gains.

Why are investors so excited about a half point rate cut? I know that the conventional response to easing conditions has been to buy risk assets, but is that really justified right now? I don’t think so and here’s why.

Rates Get Cut Because Conditions Are Deteriorating

Again, the markets generally like rate cuts immediately, but it’s important to remember that the Fed cuts rates because they think the economy needs a little help. In this case, perhaps there’s a normalization aspect to this because rates were raised so far so fast in the aftermath of 2022’s inflation spike. Still, rate cuts are not a good sign for the economic outlook and this is likely no different.

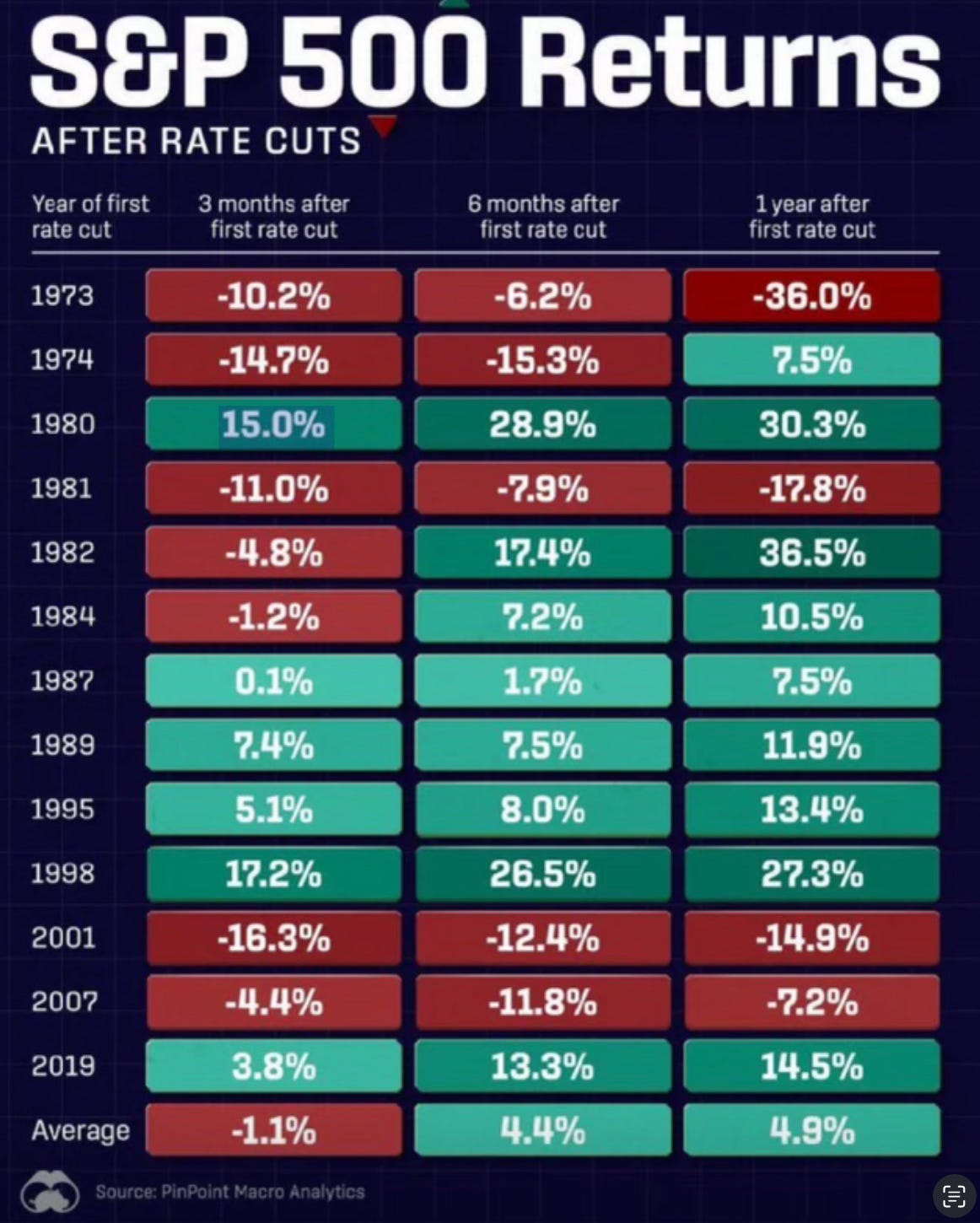

From an investor perspective, the gains in the S&P 500 may or may not be over. On average, returns following the first rate cut of the cycle tend to be modest, but the range of returns is very wide.

The one uniting factor tends to be whether rate cuts are tied to a subsequent recession. If the economy can avoid that, stocks can very well move higher. If it can’t, it’s probably downside ahead.

And that’s the message that Powell tried to drive home - that the economy is still in good shape. He’s not entirely wrong. GDP growth is still running at a 2% annualized pace. Unemployment is still just a tick above 4%. Retail sales have held up surprisingly well. The soft landing isn’t out of the question and the direction of the markets over the next 12 months will depend on whether the Fed can pull it off.

But we also know it’s not trending that way. Consumer credit delinquencies are rising. Corporate debt delinquency is rising. Unemployment is trending higher (and that was before the major downward revision of 800,000+ jobs added recently). Those aren’t signs of strength. Even though credit risk isn’t largely being priced in right now, it still exists.

Here’s perhaps a more interesting nugget.

Granted, the tech bubble and the financial crisis were two historical outliers, a 50 basis point cut right out of the gate suggests that maybe the Fed didn’t catch this downturn in time.

Powell Has Already Warned Of Labor Market Weakness

Powell’s focus over the past couple years has almost exclusively been inflation. In the past couple of months, however, he has mentioned the labor market as the biggest current risk, while downplaying inflation a bit. Inflation, of course, isn’t “solved” by any means, but as long as it’s hovering in this 2-3% range, it’s not the pressing concern it once was.

The fact that the unemployment rate has risen from 3.4% to 4.2% in a little over a year is a growing problem. We also know that job openings are shrinking and layoff announcements have risen. I rise in unemployment like the one we’re seeing now almost always coincides with eventual recession. People will try to say that “this time is different”. It probably isn’t.

Powell Didn’t Exactly Exude Confidence

During his press conference, Powell seemed to try very hard to convince people that everything was fine. The Fed’s official statement that employment and inflation risks are “roughly in balance” doesn’t seem quite right given what Powell has said before this meeting.

Powell said that the 50 basis point cut was a “commitment to us not falling behind”, but he also said that they very well could have cut in July had they had the most recent data in hand. Doesn’t that imply that they’ve kind of already fallen behind? Were they not paying attention to the trends leading up to that point?

The Fed’s Dot Plot said the central bank is currently forecasting 200 basis points of additional cuts over the next two years. Granted, this is very unreliable, but why the need for such a steep rate cutting cycle if everything is in good shape as Powell insists it is?

Here was the one statement that struck me from the presser.

Perhaps it was nothing but an innocent slip-up, but it’s curious that he used the word “recession” and then caught himself before flipping it to “downturn”. Did he accidentally say what was really on his and the Fed’s minds? We’ll probably never know, but it’s interesting that the word popped up.

Final Thoughts

Historically, Fed rate cutting cycles are not positive for the markets. They certainly shouldn’t be positive to the extent of how stocks are rallying today. They almost definitely won’t be positive if the Fed needs to cut by 200 basis points over the next 24 months.

As long as GDP growth remains positive and the unemployment rate remains in its current range, investors will buy Powell’s assertion that everything is fine. That probably sends stocks higher in the short-term.

On the other hand, credit conditions show that pressures are definitely building and that’s not usually something that resolves itself until something breaks. Ditto for the labor market. There’s probably some normalization that needs to happen given the over-hiring post-pandemic, but the rate of change is definitely a negative thing.

Stocks in the short-term might be able to hold up for a while. As credit conditions become more pronounced, the housing market starts to correct (remember, falling rates will unfreeze the market and true price discovery will finally occur) and the election adds another layer of uncertainty, it’s time to remain prepared for a potentially deeper correction for equities.

Reply