- ETF Focus

- Posts

- This 2 ETF Combo Offers A 7.5% Yield With The Risk Of Short-Term Treasuries

This 2 ETF Combo Offers A 7.5% Yield With The Risk Of Short-Term Treasuries

There's an opportunity to capture nearly double the yield for a comparable level of volatility.

Apple’s Starlink Update Sparks Huge Earning Opportunity

Apple just secretly added Starlink satellite support to iPhones through iOS 18.3.

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone already reaches +45M users that have earned over $325M, and that’s before global satellite coverage. With SpaceX eliminating "dead zones" worldwide, Mode's earning technology can now reach billions more.

Mode is now gearing up for a possible Nasdaq listing (ticker: MODE) but you can still invest in their pre-IPO offering at $0.30/share before their share price changes.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

While interest rates have been relatively volatile over the past couple years (especially lately), they've at least steadied to the point where bond investors don't face the substantial downside risk associated with an aggressive Fed rate hiking cycle.

Even though the Fed is likely to begin cutting rates later this year, there are still some good yield options out there. Treasury yields are still in the 4-5% range, depending on the tenor you choose, with higher yields available on corporate bonds based on your appetite for credit risk at the moment.

In most cases, capturing a yield in the 7%+ range involves taking much more risk.

For comparison's sake, the iShares Treasury Floating Rate Bond ETF (TFLO), which effectively eliminates almost all credit and duration risk, has a 1-year standard deviation of returns, a universal measure of risk, of 0.2%. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which still invests in short-term bonds overall, has a standard deviation of 4.6%, roughly 23 times the volatility. Longer-term corporate bonds, even high quality ones, are worse. The iShares AAA-A Rated Corporate Bond ETF (QLTA), which has a nearly 7-year duration, has a standard deviation of 6.5%.

Duration is the big driver of fixed income volatility, but all of these factors have an impact.

The best yield/volatility tradeoffs come from floating rate bonds. If you're making a bet on interest rate changes and are looking for some capital growth potential as well as yield, adding duration makes sense. If you're looking purely at income, floaters generally do better at limiting overall volatility, while delivering a competitive yield.

There are a couple of places, however, that you can find a 7%+ yield while limiting overall volatility risk in the process - senior loans and CLOs.

Senior Loans & CLOs As Lower Risk Fixed Income Options

Yes, there's a lot of overlap in these two products. A senior loan ETF, for example, probably owns a lot of individual loans in its portfolio. A CLO ETF may invest in securitized portfolios containing hundreds of senior loans. The advantage is that you can target specific tranches and ratings classifications to narrow down your exposure.

When combined you can potential improve the overall credit profile of the combination and perhaps even improve yield.

The two ETFs I have in mind for this are the Janus Henderson B-BBB CLO ETF (JBBB) and the Invesco Senior Loan ETF (BKLN).

Because they both invest in floating rate loans, the duration risk and interest rate sensitivity (again, the biggest driver of overall volatility) are very limited. The lower credit ratings do pose some risk if we run into an especially volatile period, such as the one from the first half of April, but history demonstrates that even in more challenging environments, volatility tends to be relatively contained.

While you may not want to commit your entire fixed income position to this 2-ETF combo due its somewhat concentrated exposures, I think it's at least worth considering for a part of it. The high yield/low volatility mix makes it an intriguing way to boost your monthly income.

Profiling The JBBB/BKLN ETF Combination

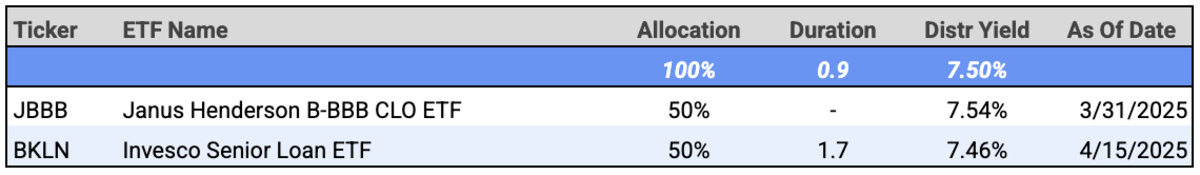

If we combine these funds together 50-50, let's first break down what it looks like.

source: Portfolio Visualizer

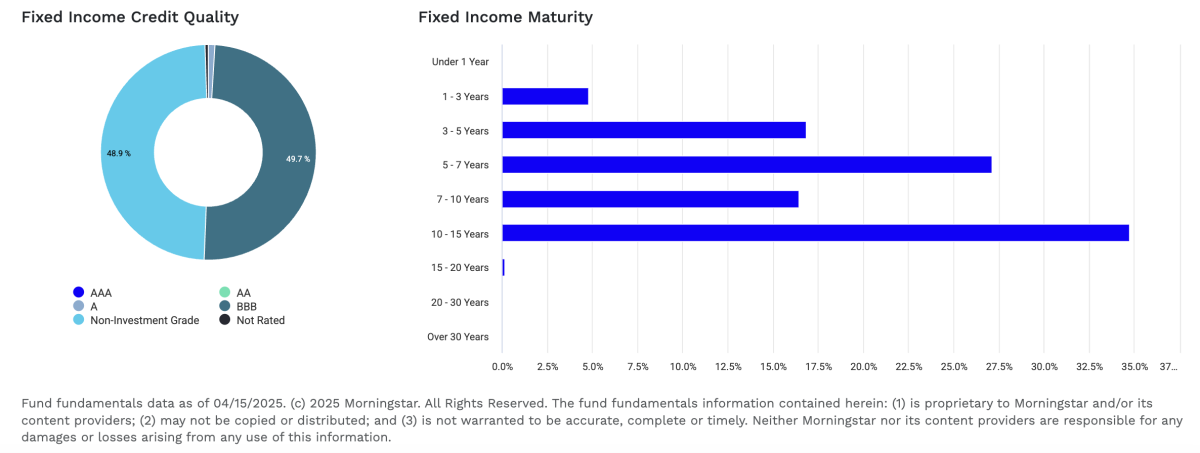

The graphic above indicates that the portfolio is about 50% non-investment grade and 50% BBB-rated securities.

While JBBB's mandate says it can invest in securities rated anywhere from BBB to single-B, it's been sticking almost exclusively to the investment-grade tier (the latest fund fact sheet shows 94% in BBB and 4% in BB). That's important because the long-term historical default rates for BBB-rated and BB-rated CLOs are about 0.5% and 2.5%, respectively. By focusing on the investment-grade tier, you're reducing default risk by 80%, yet still capturing a high yield.

BKLN's credit profile is 56% B-rated, 31% BB-rated and 10% BBB-rated. When combined, you get something like 55/15/30 split between BBB/BB/B rated securities. We'll see how the trade war could affect the ratings on some of these loans, but the slightly heavier lean towards the investment-grade side of the spectrum is likely to help versus just holding a senior loan ETF in isolation.

Tariffs Surge — This Tech Disruptor Moves Faster Than Global Shifts

Consumer electronics may have dodged the tariff bullet, but one smart home disruptor isn’t waiting for luck.

They’ve strategically secured production outside China, staying ahead of the global manufacturing shift.

That’s exactly how this company has hit 200% year-over-year growth while expanding into over 120 major retail locations.

Their smart shade technology is reshaping home automation, protected by patents and backed by powerful retail partnerships.

Smart investors spot the pattern: companies that turn global challenges into strategic wins often deliver the biggest returns.

At just $1.90 per share, you’re looking at a company that’s not just prepared for supply chain shifts — it’s already capitalizing on them.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Drawdown Risk

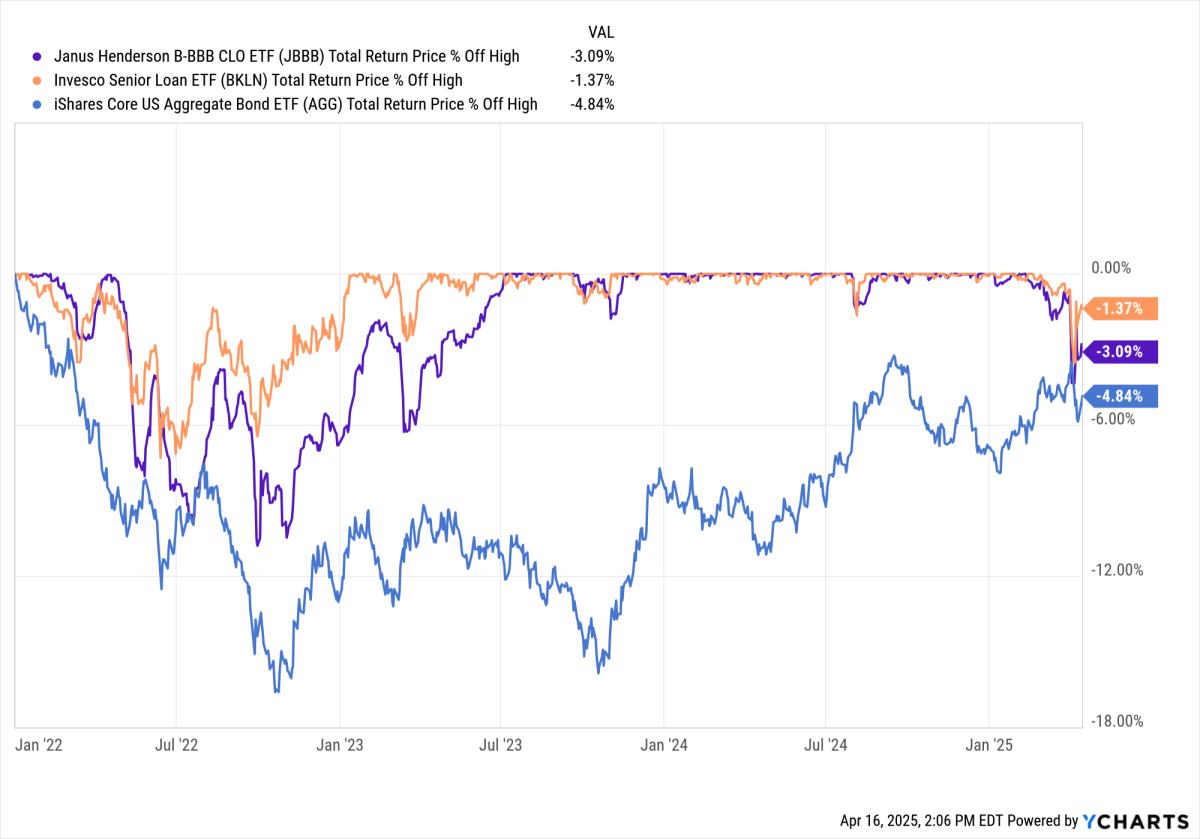

The bond bear market of 2022 demonstrated that these products aren't immune from downside risk when credit conditions are deteriorating. Still, both JBBB and BKLN posed much less downside risk than the iShares Core U.S. Aggregate Bond ETF (AGG).

Despite their similarities in portfolio composition, JBBB and BKLN only share a correlation factor of 0.66, roughly the same correlation that U.S. stocks share with emerging markets equities. That's to say that there is some diversification benefit to pairing these funds together. Even though JBBB saw a drawdown that briefly edged into the double digits, the drawdown of the combined pair was likely much less.

JBBB/BKLN Has Similar Volatility To A 3-Year Treasury

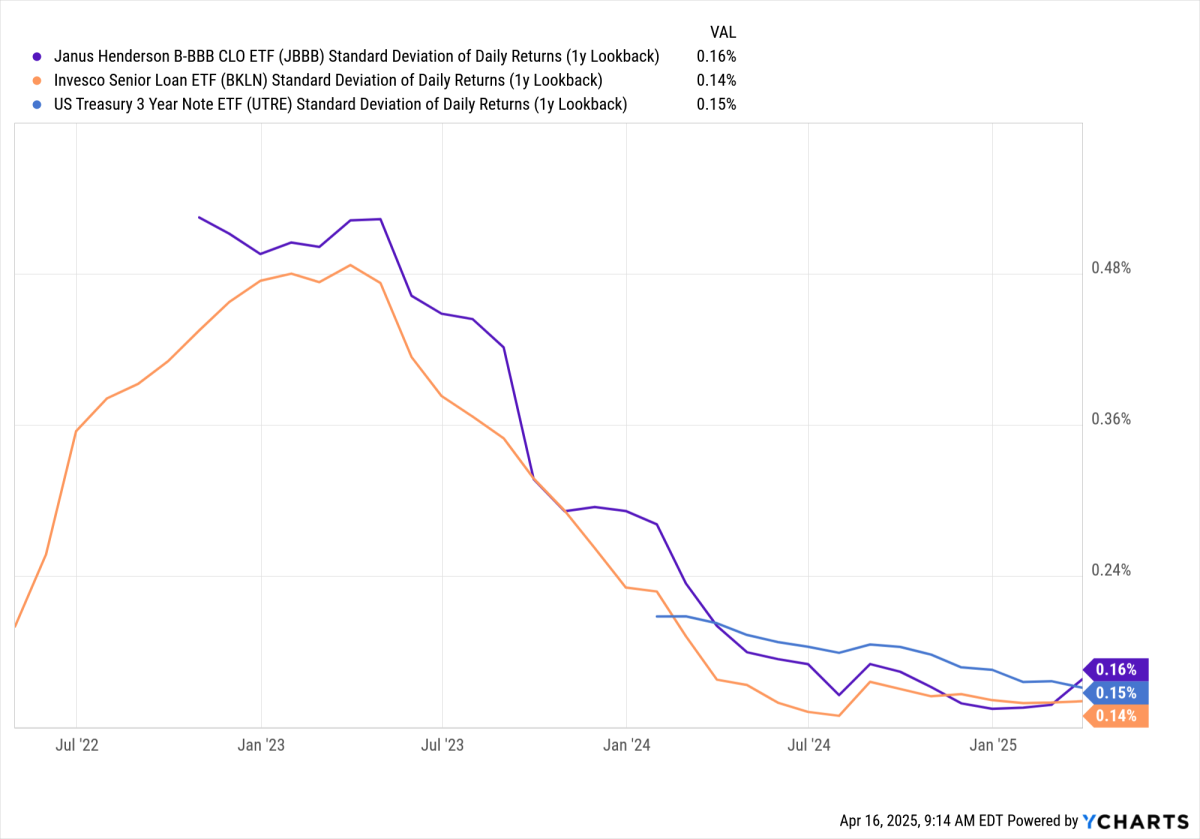

On the surface, you may not think of lower-rated CLOs or senior loans as "low risk", but the data suggests that they actually are.

When considering historical demonstrated volatility levels, the standard deviation of returns for both JBBB and BKLN fall right in line with that of the U.S. Treasury 3 Year Note ETF (UTRE).

Keep in mind that a 3-year Treasury note right now is yielding about 3.9% or nearly half that of either JBBB or BKLN. Those two ETFs obviously have more credit risk than UTRE, but UTRE comes with more interest rate risk. Your mileage may vary as to which of those two factors is more important to you at any given moment, but it terms of pure volatility of share price performance, there's a big yield advantage to be had here.

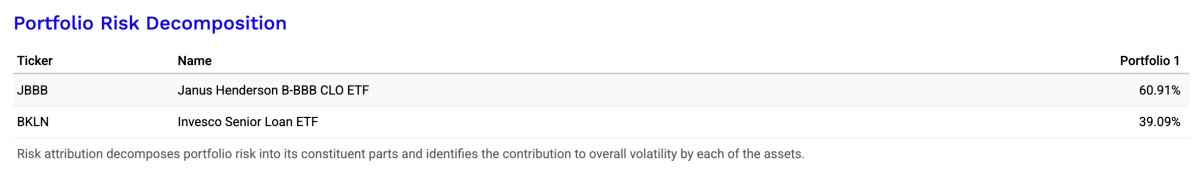

Risk Decomposition

If you combine JBBB & BKLN together and backtest the combination, we find that it's actually JBBB that's producing a larger share of risk.

This highlights an important issue that arises when investing in structured credit instruments. Why would JBBB, which invests in higher-rated securities, actually be riskier than BKLN?

The answer is likely found in the structure of the instruments themselves.

BKLN invests in individual loans, which are often priced like standard fixed income securities. That means those prices are based on credit fundamentals, interest rate sensitivity and supply & demand.

JBBB invests in tranches of collateralized securities. While credit risk and rate sensitivity are considerations, they also have to factor in lower liquidity and different cash flow characteristics. The liquidity, in particular, can be impactful, especially in deteriorating markets, and that tends to up the risk factor of the CLO.

Even though JBBB has a better risk profile, structural issues and considerations actually make it a little more volatile than BKLN.

Overall, this probably isn't a huge issue when paired together. It is a reminder though that CLOs & senior loans aren't the same as traditional fixed income securities, such as Treasuries and corporate bonds. There are some idiosyncrasies that need to be considered in the pursuit of higher yields.

Final Thoughts

If given similar volatility levels, would you prefer a 3.9% yield from a 3-year Treasury note or a 7.5% yield from a 50-50 combination of JBBB & BKLN?

While I don't think you want to necessarily make the JBBB/BKLN pairing a cornerstone of your fixed income allocation, I definitely think it's worth considering as an addition to an existing portfolio. Given that you can nearly double the yield with a comparable level of volatility, I think it makes sense.

Be mindful of how senior loans and CLOs can behave in down markets though. The lower credit ratings and lack of liquidity can make a difference if there's a big flight to safety. That's why moderation is the key.

Reply