- ETF Focus

- Posts

- Top 3 Dividend ETF Picks for May 2024

Top 3 Dividend ETF Picks for May 2024

If the current trend favoring defensive equities continues, these high yielders are set up to outperform.

The stock market finally experienced a setback in April as inflation began to re-accelerate and Q1 GDP growth came in far lower than expected. On top of that, the timing for a Fed rate cutting cycle continues to get pushed back to the point where there's a real possibility we may see no rate cut in 2024 at all. The markets have been counting on that for the past year and the impact of higher for longer interest rates are starting to weigh on the markets.

I think the Fed is fine with 3% inflation right now as long as GDP growth remains firmly positive and the unemployment rate hovers around the 4% level. If either of those latter two factors start trending in the wrong direction, the Fed may be forced to make a policy change sooner than they want and that's where things get really dangerous. This week's non-farm payroll report could provide some clues.

What Worked & Didn’t Work In April

While there was some volatility along the way, there was a soft pivot to defense that resulted in utilities and consumer staples being two of the three best performing S&P sectors. Cyclical leadership, which has been in place pretty much since the end of January, didn't fade out, but it did take a break as more defensive asset classes started to move ahead. The one consistent thing we saw throughout April was weakness in tech, growth and other winners in the post-COVID market.

The gold rally, which has been the big story since March and has been fueled by central bank buying and traders in Asia, has cooled off in recent weeks, but the preference for defense has not. Overall, we've seen low volatility, value and dividend stocks doing relatively well, although Treasuries, the traditional benchmark of a safe haven trade, have yet to participate.

The volatility and crumbling of the yen is something I've covered a lot, mostly over on Twitter/X, and I think that remains the black cloud that hangs over the entire market. The Bank of Japan has intervened multiple times over the past week in an effort to save it from collapsing further. So far, those efforts appear to be having some success, but it is creating a lot of volatility in the forex market and that usually results in negative implications globally.

3 Dividend ETF Picks for May

For this month's selections, I'm going to start with the universe of dividend ETFs according to the ETF Action database, which currently includes more than 160 ETFs.

Sometimes, I start by narrowing down the universe to just U.S. dividend ETFs, but I'm going to consider international and emerging markets ETFs as well in May. We've seen international stocks start to pick up some momentum here and the falling dollar along with generally more dovish conditions compared to the Fed could create some opportunities.

I do think the cautious tone will continue to hang over the market though. If inflation continues to remain elevated and the Fed gives no signs that rate cuts are coming, investors may decide that riskier isn't better and remain more cautious, especially if labor market data starts showing more cracks.

Last month, I used a beta of 0.80 as the breakeven point between riskier and less risky for dividend ETFs. Therefore, I'm going to start by considering dividend ETFs with a beta less than that. I'm going to start with a slightly higher 1-year beta of 0.90 or under in order to begin a little more expansively. That screen alone, however, already narrows down our choices to 57.

Next up, I want to look at sector composition. While utilities is generally considered the most conservative of the S&P 500 sectors, it's actually been more volatile than normal lately, probably due to some of the underlying volatility in interest rates. Therefore, I think consumer staples might be a better proxy for more pure defensive equity exposure. The S&P 500 has a modest 6% allocation to this sector, so I'm going to consider only dividend ETFs that have at least 10% exposure. That shrinks the list down to 34.

Now, I want a bit of a yield premium for my effort. The S&P 500 currently yields a scant 1.3%. I like dividend ETFs that substantially improve your income prospects, so let's consider only those that offer a minimum 100 basis point yield premium (or a yield of 2.3% or higher). That takes us down to 24.

Finally, I want a little bit of positive short-term momentum. Most relative strength scores are lower than normal right now based on recent market conditions, so I'm going to add a screen that looks for an RSI above 50 (or basically the mid-point for market momentum). That reduces the list all the way to the final four!

The one ETF I'm going to leave off of the final three despite meeting all of the criteria above is the Franklin U.S. Low Volatility High Dividend ETF (LVHD). The main reason is that there's another ETF that also qualified that follows a similar strategy and I don't necessarily want the overlap.

With that said, here are my top 3 dividend ETF picks for May.

Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

SPHD is one of my favorite dividend ETFs, but it needs the right kind of conditions in order for it to excel. It got that set of conditions last month and ended up as the 6th best performing U.S. dividend ETF during the month of April. If my belief that defensive conditions are likely to remain in place in May comes to fruition, it makes sense that SPHD could have another good month ahead and the screens bear that out.

SPHD starts with the S&P 500, takes the 75 highest yielding stocks out of that group and then chooses the 50 lowest volatility stocks from that subgroup. The fund maintains a nearly 40% allocation to the combination of utilities and consumer staples, which is definitely on the high side, but its 4.7% dividend yield will undoubtedly appeal to income seekers.

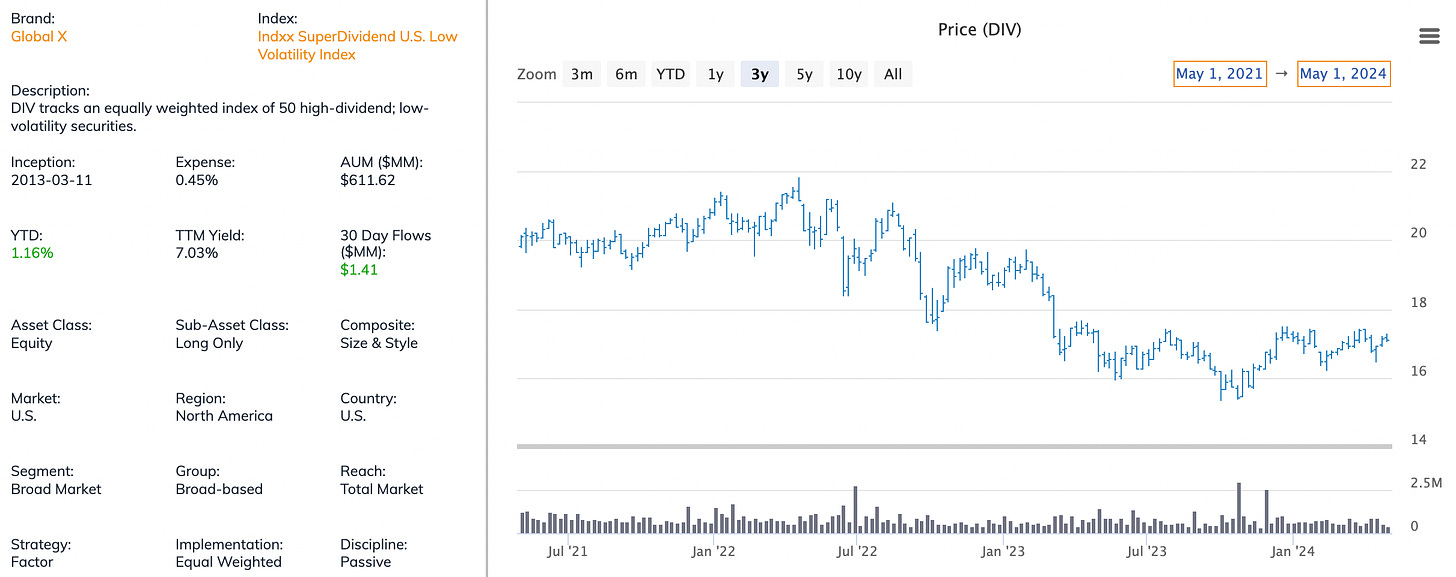

Global X SuperDividend U.S. ETF (DIV)

The "SuperDividend" name is certainly appropriate given its current 6% yield, but if you look at its selection criteria, it has a somewhat surprising number of cross-checks and a low volatility emphasis that actually reduces some risk despite the high yield. The fund starts by looking for stocks with a minimum market cap of at least $500 million, a beta of less than 0.85 and a modest dividend growth component (basically, it paid a higher dividend this year compared to last year). The 50 highest yielding stocks from that subgroup are selected for inclusion and equal-weighted.

This selection strategy actually produces a relatively low volatility dividend ETF with an ultra-high yield. The dividend growth piece is nice, although it's pretty lax, but the overall combination of lower risk and high yield could be really appealing here.

Federated Hermes U.S. Strategic Dividend ETF (FDV)

This one's probably way under the radar, but its combination of active management, above average yield and long-term dividend growth potential make it an intriguing ETF. The security selection process involves target stocks based on attractive combinations of dividend yield and dividend growth potential over time using fundamental criteria, such as balance sheet strength, earnings growth, and cash flow durability. It also looks for stocks with a higher dividend yield than the S&P 500.

This fund falls squarely into Morningstar's Large Value category, so it'll need current conditions to keep carrying forward in order to outperform. FDV has a current yield of 3.4%.

Reply