- ETF Focus

- Posts

- Vanguard Dividend ETFs: 4 Options For Long-Term Income Growth

Vanguard Dividend ETFs: 4 Options For Long-Term Income Growth

Each of these dividend ETFs is solid in isolation, but let's take a look at their factor exposures to see how well they fit together.

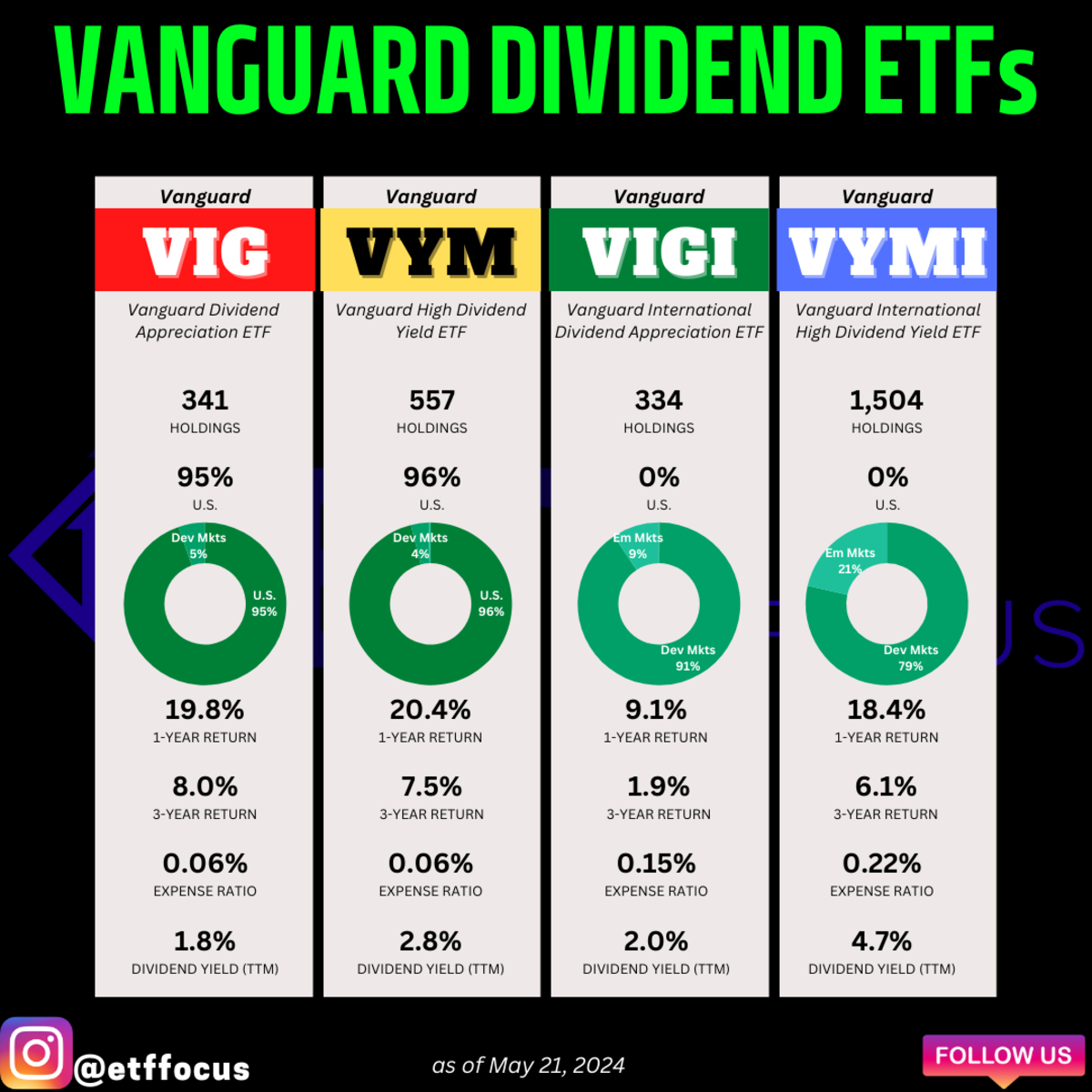

In a marketplace of more than 160 dividend ETFs, it might be surprising to know that Vanguard, one of the kings of the industry, has only four of them. Some issuers choose to broaden their lineups through overly niche or targeted strategies, but Vanguard keeps it really simple - focus on broad diversification across popular dividend income themes and offer them as cheap as possible.Watch More

As a result, that quartet of dividend ETFs have become leaders in their respective spaces.

Those ETFs:

Vanguard Dividend Appreciation ETF (VIG)

Vanguard High Dividend Yield ETF (VYM)

Vanguard International Dividend Appreciation ETF (VIGI)

Vanguard International High Dividend Yield ETF (VYMI)

Straightforward and simple. Dividend growth and high yield. U.S. and international.

Any of these ETFs would make great cornerstones for a dividend income portfolio depending on what you're looking for. Admittedly, I have some issues with the funds based on 1) their overly broad selection strategies and 2) their focus on just a single dividend strategy as opposed to a multi-factor one. But the fact is that if you're looking for very simple exposure to a broad array of dividend stocks, these ETFs will work just fine!

Let's start by breaking them down one by one.

Learn how to become an “Intelligent Investor.”

Warren Buffett says great investors read 8 hours per day. What if you only have 5 minutes a day? Then, read Value Investor Daily.

Every week, it covers:

Value stock ideas - today’s biggest value opportunities 📈

Principles of investing - timeless lessons from top value investors 💰

Investing resources - investor tools and hidden gems 🔎

You’ll save time and energy and become a smarter investor in just minutes daily–free! 👇

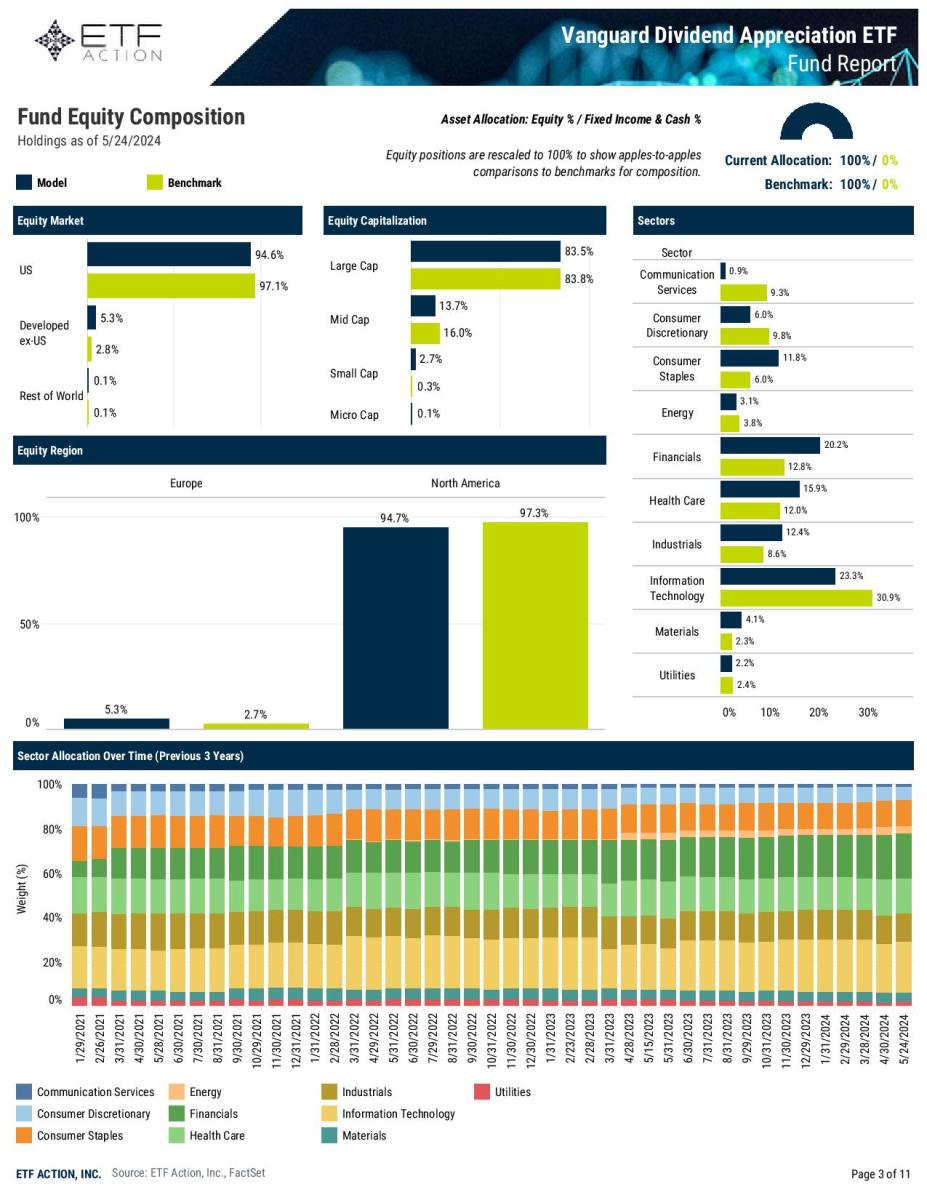

Vanguard Dividend Appreciation ETF (VIG)

Index: S&P U.S. Dividend Growers Index

Description: VIG tracks a market-cap-weighted index of US companies that have increased their annual dividends for 10 or more consecutive years.

AUM: $79.2 billion

Closest Comps: Invesco Dividend Achievers ETF (PFM), Strive 1000 Dividend Growth ETF (STXD), iShares Core Dividend Growth ETF (DGRO)

Advantages

VIG's requirement of just 10 consecutive years of dividend growth allows it to capture some of the "emerging" long-term dividend growers that the dividend aristocrat definition (25+ years) would eliminate. The most notable result of this is that VIG has a much larger tech allocation. Its two largest holdings are Microsoft and Apple, together accounting for more than 7% of the fund's assets. Therefore, you get the dividend growth history with a little extra growth potential that you might not find in other dividend ETFs.

VIG's strategy is simple, straightforward and easy to understand. You don't need to examine price/book ratios or cash flows or earnings coverage or payout ratios to know why a stock is being included and why it isn't.

Disadvantages

VIG's strategy of looking only at dividend history doesn't preclude it from including some bad apples. Just because a company has paid a dividend for years doesn't mean they can't cut it at any time or find themselves in a challenging financial position (some companies will take on debt just to pay a dividend so they don't break their streak). That's why I like dividend ETFs that incorporate a quality component along with the dividend growth history because they can act as a cross check against other.

VIG holds more than 300 stocks. Once you start getting into the triple digits, the portfolio can start getting watered down and behave a whole lot like the broader market. Even the fund's cap-weighting strategy ignores the company's dividend history (beyond the 10+ year requirement) and overweights larger companies, something that the S&P 500 does.

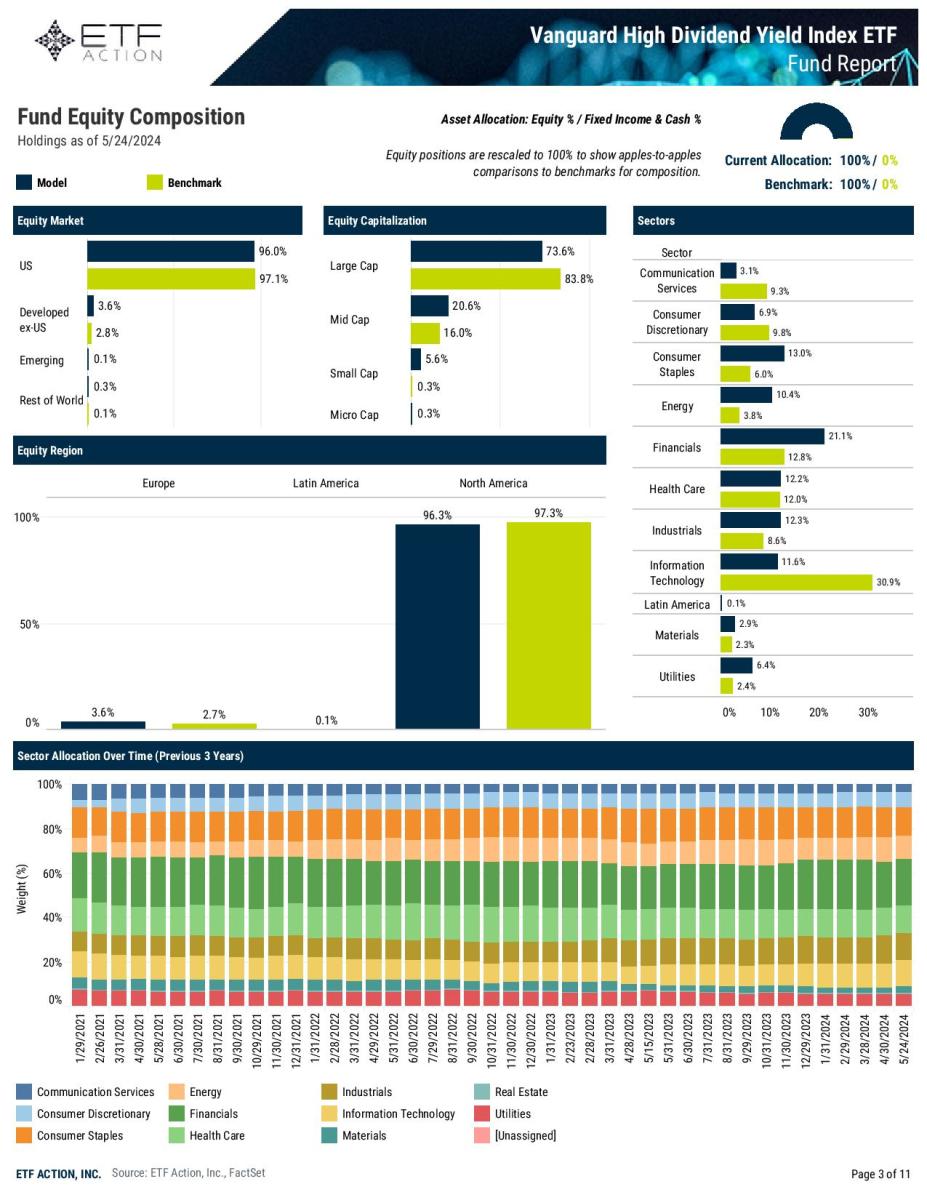

Vanguard High Dividend Yield ETF (VYM)

Index: FTSE Custom High Dividend Yield Index

Description: VYM tracks the FTSE High Dividend Yield Index. The index selects high-dividend-paying US companies; excluding REITS; and weights them by market cap.

AUM: $54.7 billion

Closest Comps: Vanguard Mega Cap Value ETF (MGV), iShares Core Dividend ETF (DIVB), Vanguard Value ETF (VTV)

Advantages

High yield strategies can be dangerous because they may ignore company fundamentals altogether. Stocks may have high yields strictly because their share prices have dropped or they may be getting poised for a dividend cut. VYM's selection strategy doesn't necessarily address that risk, but it's inclusive enough that it diversifies away a lot of that risk. If you're looking for a gentle step into high yield stocks, VYM's strategy will probably serve you well.

The fund's dividend yield of 2.8% isn't nearly as high as you could get with other high yield ETFs, but it is more than double that of the S&P 500 and takes a less targeted approach to capturing that yield than you'll find elsewhere.

Disadvantages

VYM essentially takes a large starting universe and includes a stock if its yield falls in the top half. Should a stock be considered "high yield" if its dividend falls in the 51st percentile? I'd argue no. A true high yield portfolio probably shouldn't include more than 550 stocks because it'll get watered down really quickly with a lot of modest yielding stocks. The market cap weighting scheme doesn't really help either because it de-emphasizes higher yielding stocks.

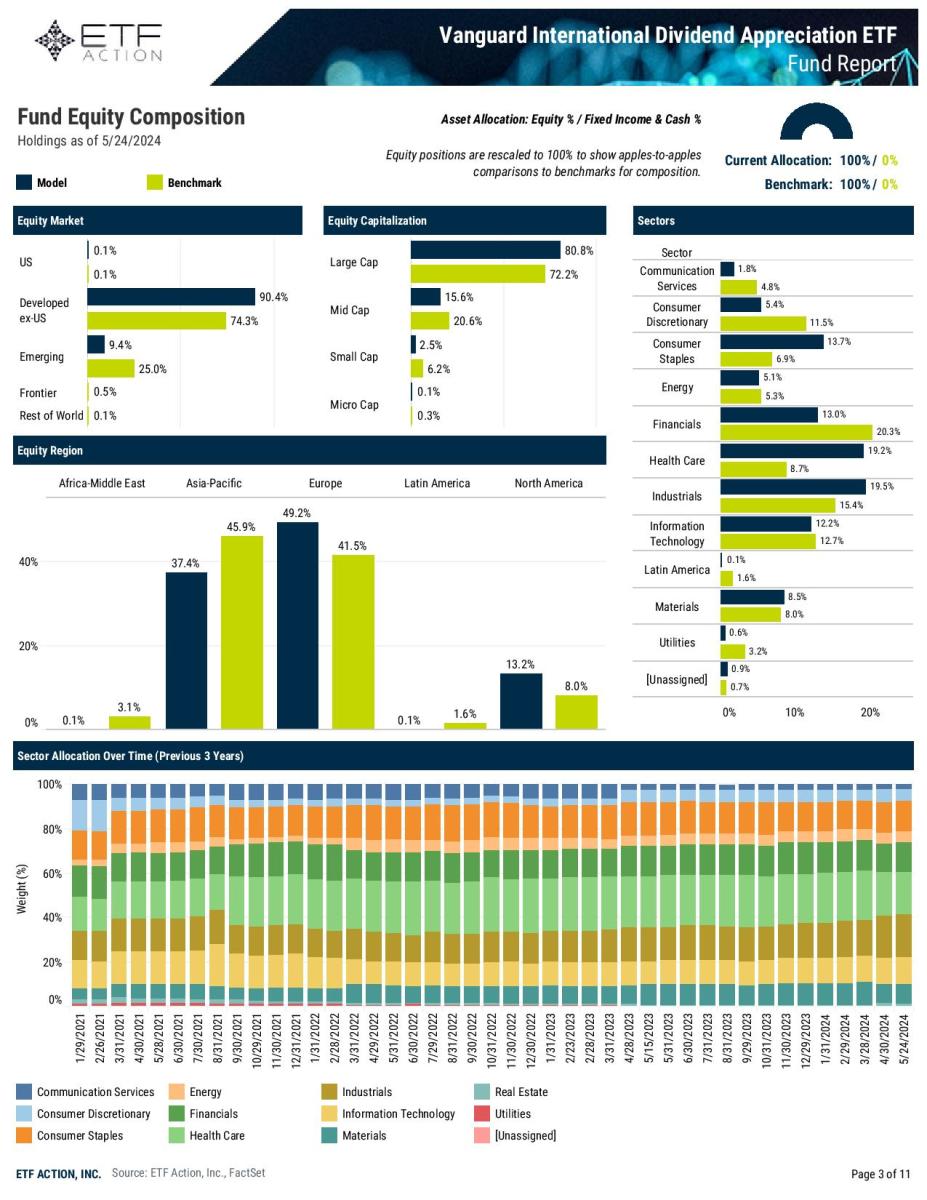

Vanguard International Dividend Appreciation ETF (VIGI)

Index: S&P Global Ex-U.S. Dividend Growers Index

Description: VIGI tracks the performance of a benchmark index that measures the investment return of non-U.S. companies that have a history of increasing dividends.

AUM: $6.7 billion

Closest Comps: iShares International Dividend Growth ETF (IGRO), ALPS O'Shares Europe Quality Dividend ETF (OEUR), Invesco S&P International Developed High Quality ETF (IDHQ)

Advantages

VIGI requires a more modest 7 consecutive years of dividend growth to qualify. That's not necessarily a very high bar to clear, but it is consistent with the lesser dividend focus from overseas. Even though VIGI only requires that dividend growth track record to qualify, I like that two of its closest comps, IGRO and OEUR, are quality-focused portfolios. The Morningstar factor profile also confirms that VIGI scores highly for quality. That's a distinct advantage when investing overseas because of differing regulatory and reporting requirements can make analyzing balance sheets and cash flow statements a little more challenging.

VIGI has also done a nice job of delivering superior risk-adjusted returns. Since the Vanguard Total International Stock ETF (VXUS) launched in early 2016, VIGI has managed to outperform it by a slight margin, but has done so with 10% less risk. The modest overweights to both large-caps and developed markets stocks will appeal to those who don't want to venture too far out on the risk spectrum in the pursuit of yield.

Disadvantages

Like VIG, VIGI's 2% yield isn't going to elicit much excitement. Part of the reason for this is that the fund's index eliminates REITs and the 25% highest yielding eligible companies before the final portfolio is even constructed. The exclusion of REITs isn't unusual given how their higher yields and volatility can create some instability. There are also funds out there that will eliminate, say, the top 10% highest yielders in order to avoid some potential idiosyncratic risk associated with artificially high yields. The exclusion of the top 25%, however, feels a little steep. I like the idea of a portfolio of strong and stable dividend payers, but it feels like there's a bit much that's being excluded in order to achieve it.

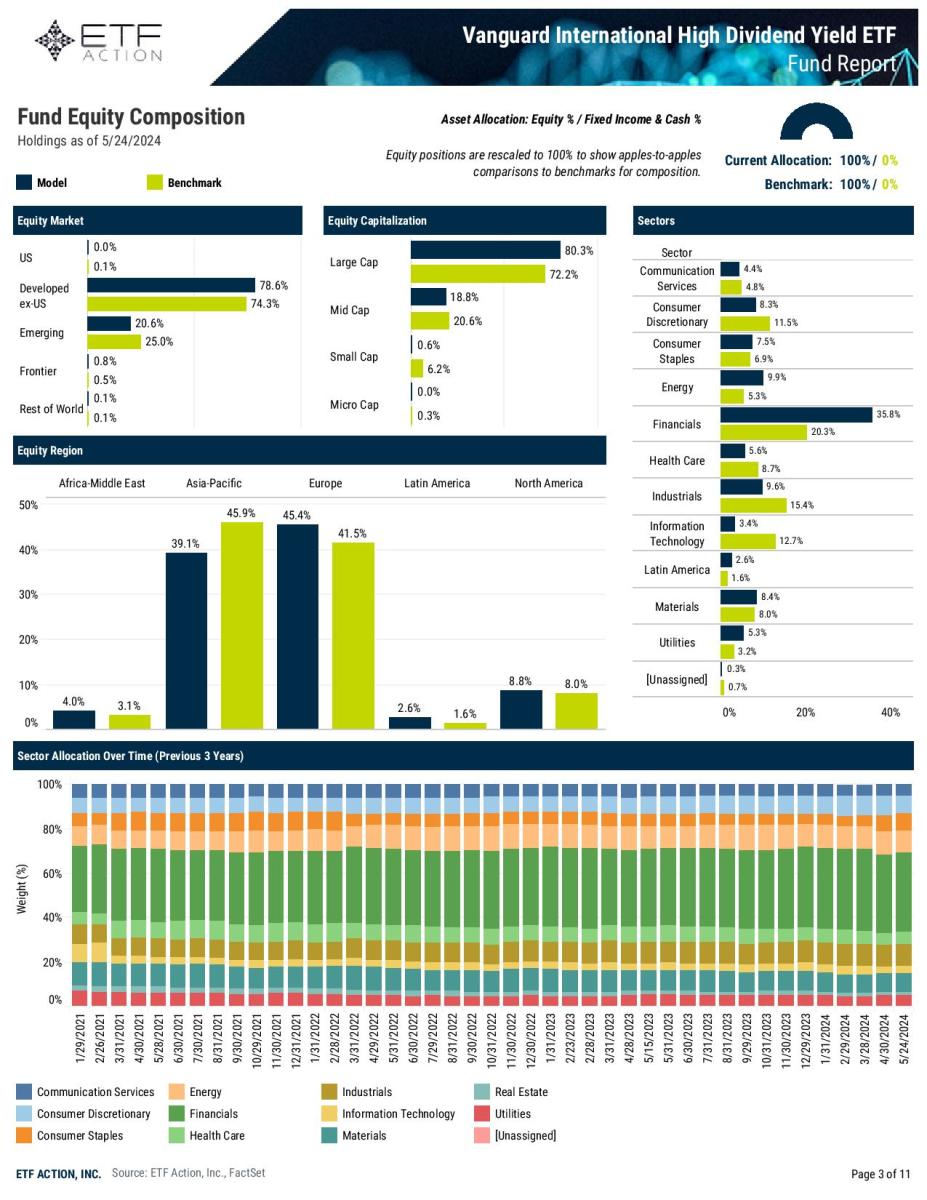

Vanguard International High Dividend Yield ETF (VYMI)

Index: FTSE Custom All-World ex US High Dividend Yield Index

Description: VYMI tracks a market cap-weighted index of developed and emerging market firms (ex-US) that are expected to pay above average dividends over the next 12 months.

AUM: $7.7 billion

Closest Comps: Invesco FTSE RAFI Developed Markets ex-U.S. ETF (PXF), iShares MSCI EAFE Value ETF (EFV), Schwab Fundamental International Large Co. Index ETF (FNDF)

Advantages

Like VYM, VYMI takes a more defensive approach to dividend investing. It looks at a company's forecasted dividend yield over the next 12 months and selects the top half of qualifiers from a broad dividend stock universe. The fund's market cap weighting methodology creates a comprehensive portfolio of dividend payers that tilts towards larger and more developed companies. International investing can be intimidating and VYMI's rather conservative approach to high yielders is likely to be preferred by investors with some hesitations.

If you like the high yields currently being offered by emerging markets companies, you'll probably find VYMI to your liking. A full 20% of the portfolio is dedicated to emerging markets, making it one of the more heavily-tilted international dividend stock funds there is.

Disadvantages

VYMI currently has more than 1,500 holdings. Should that many stocks be qualifying for a high yield portfolio? I understand that there are advantages to taking a more conservative approach to investing in these kinds of stocks (REITs are excluded as well), but at some point I think you want to take a more targeted approach. You could either take the top 500 high yield stocks and market cap weight them. You could stick with the original 1,500 names and yield-weight the portfolio instead. There are other ways to do it that could make VYMI more of a pure yield play. With a trailing 12-month yield of 4.7%, there could be enough income here already to satisfy many yield seekers, but the fund's generalized security selection process has some drawbacks.

That 36% allocation to financials is on the high side and could be overexposing shareholders to a single sector.

How Do The Vanguard Dividend ETFs Fit Together?

A lot of people like to use Vanguard dividend ETFs collectively in their portfolio, so it's important to see how these funds fit together, where the strengths & weakness are and where there might be any gaps that need to be filled.

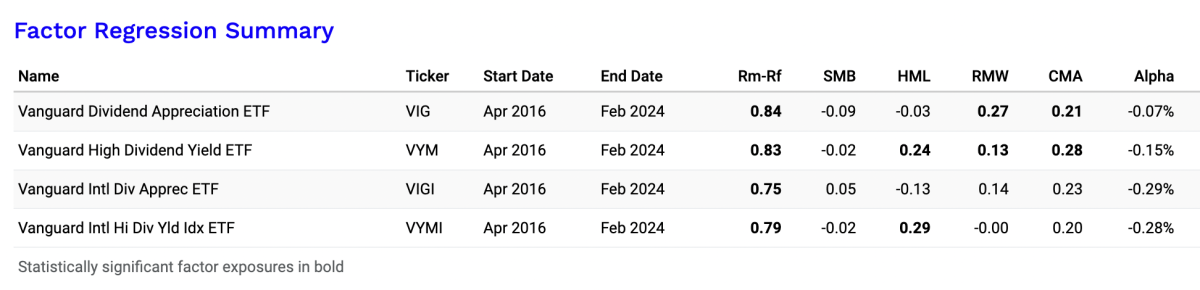

Let's lay out the factor exposures first and then we can break it down further.

source: Portfolio Visualizer

To set the table, the factor labels are as follows.

Rm-Rf - market risk factor

SMB - small-cap factor

HML - value factor

RNW - profitability factor

CMA - conservative investment factor

In general, most of a fund's risk is going to come simply from its exposure to the equity markets. From there, the portfolio will tilt one way or the other depending on the portfolio's composition.

Small-Cap Factor

We see that there's virtually no small-cap tilt in any of the ETFs. Since they're all market cap weighted, that's no surprise. No need to spend any more time on this.

Value Factor

Both VYM and VYMI have high value tilts. Most portfolios that focus on high yielders tend to find themselves overweight in certain sectors - in particular, financials, energy, industrials and consumer staples - which, in turn, leads to sometimes significant underweights in tech and growth.

VYMI is the best example of this as it's massively overweight in financials and has almost no exposure to tech. VYM has a similar composition, although not nearly as concentrated as VYMI. Financials, again, account for the highest sector allocation, but there are also double digit exposures to consumer staples, industrials and energy. High yield equity portfolios tend to be heavier in cyclicals and cyclicals tend to be much more value oriented than the broader market averages, as we're seeing here.

VIG and VIGI have no major value or growth tilts. They're much more right down the middle.

Profitability Factor

The U.S. dividend ETFs both have statistically significant factor loadings to profitability/quality. This shouldn't be a major surprise either since long-term dividend growers and high yielders generally need to have the cash flows in order to support those dividend payments.

I'm particularly happy to see this with VYM. ETF strategies that focus almost exclusively on yield have the potential of letting bad apples into the portfolio, companies whose yield is artificially high due to a falling stock price or may be at risk of making a cut. If VYM's portfolio shows stronger profitability characteristics, that makes the high yield more sustainable (and with hundreds of holdings, individual security risk should be mitigated).

VIGI and VYMI don't have these statistically significant features, although VIGI still shows some promise. It's not a huge concern since there's no evidence that they're heavily skewed towards less profitable companies, but it's something to be aware of.

Conservative Investment Factor

All four of these ETFs show conservative investment leans, which is to be expected from dividend stock portfolios. I'm not sure why the international fund factors aren't rating as statistically significant, but I'm seeing enough to convince me that there's no undue risk here.

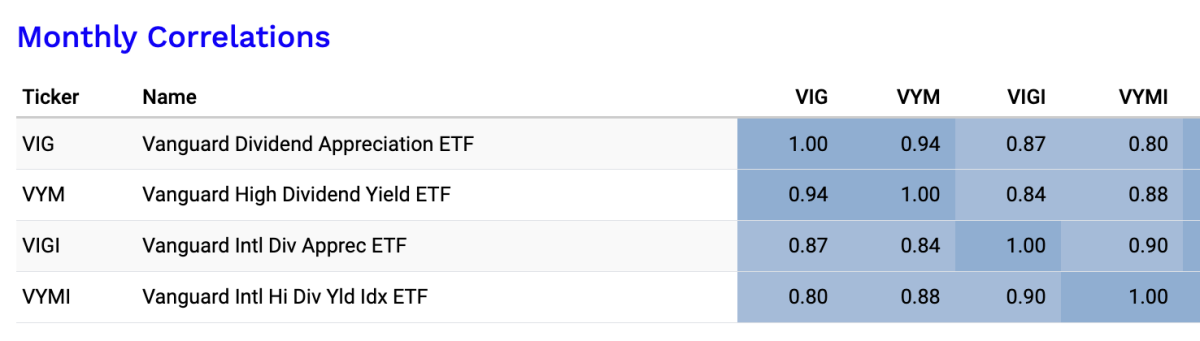

ETF Correlation Analysis

U.S. equity portfolios (with the exception of those very niche or concentrated) are usually highly correlated with each other no matter what. International ETFs provide more diversification, which is one of the main benefits of including them in a broader portfolio.

source: Portfolio Visualizer

In reality, all four of these ETFs are pretty high correlated to each other, especially within VIG/VYM and VIGI/VYMI. They're even more highly correlated to their respective broad market benchmarks.

Truthfully, there's not a whole lot of diversification benefit to be had unless you're pairing a U.S. dividend ETF with an international one. That's usually what's to be expected and it's certainly the case here as well.

Final Thoughts

There are two distinct findings when looking at factor exposures - high dividend yielders have much more of a value tilt and U.S. dividend ETFs score much better on quality. That makes the case for why if you're going to add a pair of these funds to your portfolio, it should be one of VIG/VIGI and one of VYM/VYMI. Pairing the two dividend growth ETFs or the two high yield ETFs doesn't really add much of anything in terms of factor exposures or diversification.

A lot of investors don't like the idea of investing internationally. That's understandable given the years of underperformance and higher risk that hasn't been rewarded. That may actually be a reason for why investing overseas is importance. These things have historically gone through long cycles of out/under-performance. For example, international equities, both developed and emerging markets, steadily outperformed the S&P 500 throughout the entire decade of the 2000s. U.S. stocks have pretty much been in control since 2010 and international stocks could be due for their long overdue comeback.

In summary, all four of these Vanguard dividend ETFs could be great portfolio options. They're among the very cheapest in their respective spaces and, while there are some nitpicks I have with the selection strategies, they'll work for most investors.

I do believe in international diversification if you're pairing these funds and the dividend growth/high yield pairing also makes more sense.

Reply