- ETF Focus

- Posts

- Weekly Market Prep: June 24, 2024

Weekly Market Prep: June 24, 2024

Will last week’s 10% correction in NVIDIA shake investor confidence?

Copper is up 70%

Discover the Zonia Advantage

Up to 4x faster to revenues vs. typical mines

1-Billion lbs+ of Copper in global copper inventory

Copper +70% over last 5 years

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

What We're Talking About This Week!

Weekly Market Reset

Market gains finally spread out a little after two weeks that were dominated by tech stocks, but that may only be because of NVIDIA’s 10% plunge at the end of last week. Growth stocks & sectors, whether you want to look to absolute market performance or investor flows, show that these are still the only leaders of the moment. As long as investors remain optimistic that 1) rate cuts are coming (there’s currently a 65% chance of a September cut being priced in) and 2) the disinflationary trend is still intact, it might be tough for tech to loosen its grip on this market.

A series of weaker than expected PMI readings show that the global economy is indeed slowing down, although it appears to be happening at a relatively slow pace. If we assume that the Fed has pulled off the soft landing here, the next step will be to sustain it. Rate cuts help ensure that, but I’m not sure the economy or the Fed is ready for that just yet. In reality, we need to see at least another month demonstrating that inflation is cooling before the central bank even considers lowering rates here, but I suspect they’re going to be ready to pull the trigger in September barring another round of contradictory data before then. Multiple Fed members have gone on record urging patience in the process, so I don’t think a September cut is as likely as the market thinks it is, but I wouldn’t be surprised to see the decision go either way at this point. Regardless, we’re a long way from that date and there’s a lot of data to digest before that point.

Treasury yields appear to be stabilizing at the surface, but I’m a little concerned that we’re starting to see yield spreads rising here, particularly on the higher quality end of the spectrum. AAA-rated spreads are up to their highest level since January and that’s an indicator that investors might be getting a little more defensive under the surface. Because this slowdown seems to be happening at a glacial pace, the market signals that indicate a pivot to defense are also moving quite slowly.

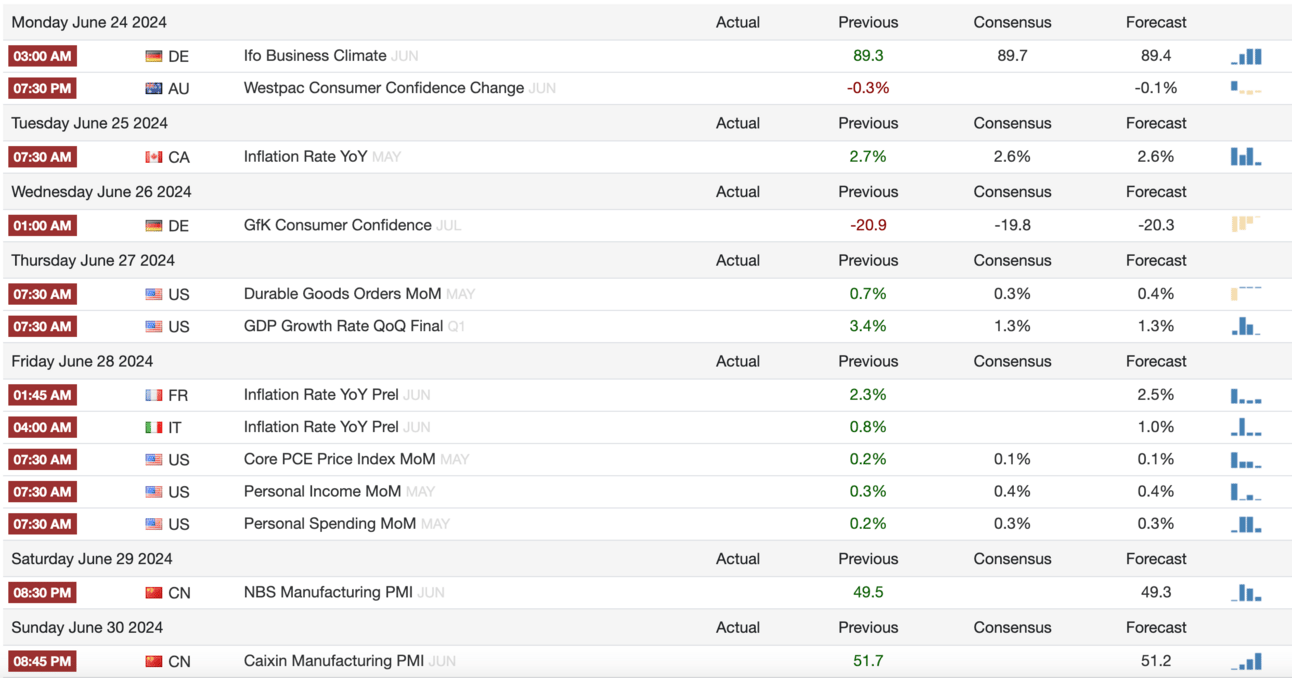

Key Economic Reports This Week

source: TradingEconomics.com

Friday will bring the next reads on both inflation and consumer sentiment in the United States. The PCE number will be watched particularly closely because 1) it could provide a sense as to whether May’s lower inflation readings signaled a genuine disinflationary pulse or were just an outlier and 2) it could make a big difference in whether a September rate cut could actually happen. The markets currently believe that a September cut is more likely than not and a tepid number on PCE could send markets rallying at the end of the week.

We’ve seen evidence in recent weeks that consumers might finally be wearing out thanks to persistent high prices and high interest rates. Retail sales numbers have been mixed and a drop in personal spending could indicate that the soft landing is being held up by a weak foundation. This number will need to be taken in conjunction with consumer debt levels because increased spending coupled with increased credit card debt doesn’t necessarily suggest consumer strength. It just indicates people using their credit cards to get by and that’s the dynamic that I think the market is underappreciating.

The Chinese manufacturing numbers next weekend are very likely going to get weaker. We’ve seen slowdowns all across the region and there’s little indicating that we’re about to see a reversal.

Dividend Landscape

Dividend stocks saw a nice rebound thanks to improved market breadth and a recovery in cyclicals, but this group may be stuck in no man’s land here. Dividend stocks were a popular income choice when the Fed kept rates near zero because there was almost no other option for yield. That was a big reason why they performed so well in 2022. Now that T-bills are yielding north of 5%, they’re not nearly as attractive.

If interest rates continue trending lower, it should be positive at the margins for dividend stocks, but investors seem solely interested in tech & growth stocks if they want equity exposure. That means we’ll likely need some sort of move towards a recessionary environment before dividend payers develop some type of sustained uptrend versus the S&P 500. For now, it seems like dividend stocks are destined for just short spurts of outperformance here and there, but nothing long-term until conditions change significantly.

Market Outlook

Unless we get some type of surprise reading on PCE late in the week, positive momentum is likely to carry forward. The one wild card could be how investors react to last week’s 10% pullback in NVIDIA. I suspect that the markets are going to use the weekend to digest it as a buying opportunity and send the stock higher again this week, lifting the major averages.

We could get better clues from the bond market. Yields look sustainable for the time being, but Friday could deliver some volatility should the PCE or personal spending data come in different from expectations. Given the number of potentially negative macro catalysts looming, I’d be cognizant of managing risk here, but I don’t think this is the week where things fall apart.

Looking better for: tech, utilities, Treasuries

Looking worse for: TIPS, consumer staples, China

Reply